Crude Oil and Refined Products Market Review and Outlook

Oil benchmark rose on Friday 12th April 2024 in anticipation of Iran’s retaliatory attack against Israel, with prices touching their highest since October 2023. This rise in oil prices, which hit a six-month high on Friday, emanates from the alleged Israeli attack on the Iranian embassy in Damascus. This prompted Iranian threats of retaliation, raising security concerns in the Middle East. Iran, one of the largest oil producers in the world, produces more than 3 million barrels of crude oil per day. Its retaliation threats have raised concerns about a wider regional conflict. Crude oil price therefore rose by 5.79% in the window under review. The price of crude oil per barrel rose from USD85.44 to USD90.39. Although increase in global demand has been a major driver of the recent rises in crude price (OPEC+ has projected global demand to grow by about 2.25 million bpd this year), the surge in this window is largely attributable to Iran’s retaliatory threats.

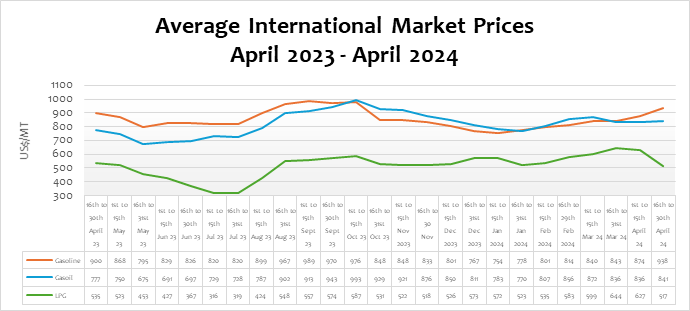

The international prices of petrol and diesel rose by 7.27% and 0.68%, respectively, while LPG declined significantly by about 17.52%. Compared to the same period last year, petrol and diesel prices rose by 4.16% and 8.33%, respectively, while LPG declined by 3.37%. On a year-to-date basis, the international market price of petrol and diesel surged by 24.41% and 7.49%, respectively, while LPG declined by 9.11%.

According to a Reuters report, Iran launched explosive drones and missiles at Israel late on Saturday 13th April in retaliation for the Israeli attack on its consulate in Syria on April 1, a first direct attack on Israeli territory that has stoked fears of a wider regional conflict. Experts are of the view that any response from Israel might lead to a wider regional conflict, which will have a major impact on global crude oil supply and prices.

FuFeX30 and Spot Rates

The Fufex30[1] for the second selling window of April (16th to 30th April 2024) is estimated at GHS13.9000/USD, while the applicable spot rate for cash sales is GHS13.6000/USD based on quotations received from oil financing commercial banks.

| SUMMARY REPORT ON BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 1st to 15th December 2023 | 19% | 11.9131 |

| 16th to 31st December 2024 | 29% | 12.1512 |

| 1st to 15th January 2024 | 19% | 12.1497 |

| 16th to 31st January 2024 | 31% | 12.1369 |

| 1st to 15th February 2024 | 21% | 12.3948 |

| 16th to 29th February 2024 | 23% | 12.4888 |

| 1st to 15th March 2024 | 23% | 12.7291 |

| 16th to 31st March 2024 | 22% | 12.9737 |

| 1st to 15th April 2024 | 30% | 13.1160 |

The BoG’s bi-weekly FX auction to BIDECs in the 1st to 15th April 2024 pricing window for the purchase of petroleum products was US$20 million, representing 30% of BIDECs’ bid. The FX rate at which the BoG auctioned to BIDECs was GHS13.1160/USD, representing a depreciation of 2.95% compared to the previous window’s rate. The BOG auction rate has depreciated by about 7.95% from the beginning of the year and about 10.10% from November 2023 to April 2024.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

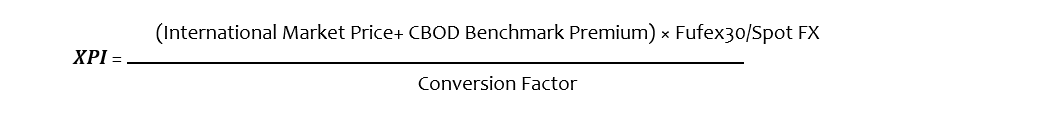

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window, and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 16th to 30th April 2024

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 937.6800 | 841.3800 | 517.3800 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 120 | 120 | 260 |

| Spot FX Rates | 13.6000 | 13.6000 | 13.6000 |

| FuFex30 (GHS/USD) | 13.9000 | 13.9000 | 13.9000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 10.8603/ltr | 11.0482/ltr | 10.5724/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 11.0999/ltr | 11.2919ltr | 120.8056/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 16th to 31st March 2024 selling window accounted for 24.0%, 22.0%, and 15.0% of the ex-pump prices of petrol, diesel, and LPG, respectively.

| TRM Components | Gasoline (GHS/ltr) | Gasoil (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.85 | 0.85 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 3.22 | 3.20 | 2.11 |

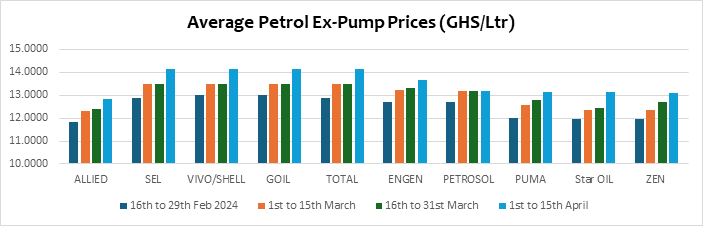

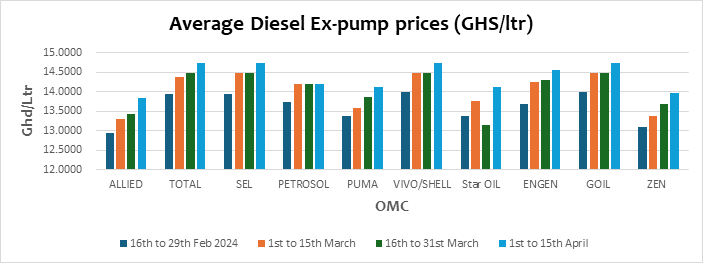

OMC Pricing Performance: 1st to 15th April March 2024

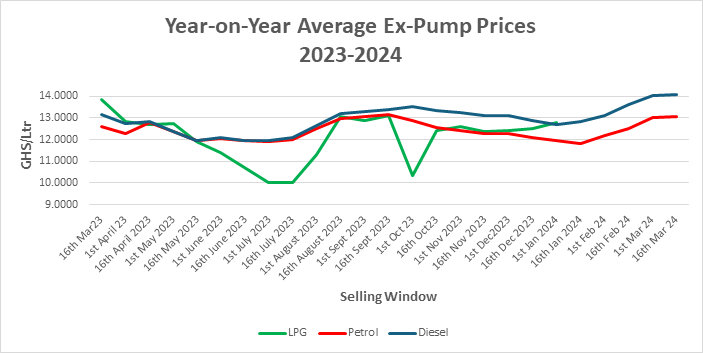

The average pump prices of petroleum products for the 1st to 15th April 2024 (the first pricing window of April) surged by an average of 3.7% and 2.2% for petrol and diesel, respectively. This rise is primarily attributed to the sharp depreciation of the Cedi against the US dollar in the first quarter of the year. At the global level, prices of crude and petroleum products continue to rise due to increasing global demand and supply bottlenecks. The recent tensions between Israel and Iran are expected to increase global prices if calls for restraint are not heeded.

The Ghanaian Cedi has risen over a difference of GHS1.00 against the USD since January, this has impacted the pricing of petroleum products, which has also risen by about USD120/MT and USD50/MT for petrol and diesel, respectively, since January.

Pump prices of petrol have risen by over 45% since March 2022 and by over GHS1.50/Ltr since January 2024. The pump price of petrol, which averaged GHS9.3390/Ltr, is currently being quoted at about GHS14.1900/Ltr by some OMCs. This surge is largely blamed on the sharp depreciation of the Cedi against the USD since the beginning of the year. Since January, the Cedi has lost about GHS2 to the USD. This, coupled with the international supply chain bottlenecks, continues to drive the pump prices of crude and other petroleum products.

Pump prices for diesel have risen above GHS14.50/Ltr for the first time since February 2023. In Q1 of 2023, the Cedi depreciated significantly against the USD due to the decline in the BOG’s foreign exchange reserves. As a result, pump prices for petroleum products escalated significantly. However, the approval of the IMF loan facility to Ghana curtailed the sharp depreciation of the Cedi and has since lowered pump prices to sell below GHS14/Ltr. The recent depreciation of the Cedi has again forced the diesel pump price to surge above the GHS14/Ltr mark. Diesel currently sells at an average of GHS14.3710/Ltr, compared to GHS12.7450/Ltr and GHS10.2740/Ltr in 2023 and 2022, respectively.

Pump prices of petrol, diesel, and LPG are expected to increase due to the surge in global demand, cuts in production by some OPEC+ nations, attacks on some refineries in Russia by Ukraine, tensions between Israel and Iran and the continued depreciation of the Cedi against the US Dollar.