With the double negatives of a demand-culling pandemic and wildly declining sentiment trouncing the oil and gas and pushing companies to record lows, with $30 billion in collective debt , trying to pick a winner in this sector is growing more challenging by the day.

On the demand front, the IEA has just cut its 2020 oil production forecast by 140,000 bpd to 91.9 million bpd, sending the FTSE 100 index down 73 points, citing the airline industry’s troubles as a key source of weakness in the oil market.

But the megatrend of ESG, or “impact” investing, is the wider threat to the oil and gas industry, with energy stocks finding themselves in the penalty box due to heightened concerns about ever-rising carbon emissions and poor governance. It’s all prompting capital fleeing the sector at an unprecedented rate—even faster due to the pandemic.

The energy sector has been the worst performer in the S&P 500, gaining just 34% over the timeframe according to Refinitiv data . And in the three-month period to June, Big Oil posted massive losses as the demand shock set in.

It’s all about slashing shareholder distributions, racking up debt and writing down assets.

The name of the game now is to find that rare company that’s sitting on something big, cashed up, fully funded, aware of the ESG megatrend, and ready to rage like a bull when oil prices start to bounce back.

Here are three stocks for every risk level, large-cap, mid-cap and small-cap that could buck the trend in the oil comeback:

Large-Cap: Marathon Oil ( NYSE:MRO )

Banking on wild sentiment, and the “Robinhood effect”, Marathon is a clear winner, despite depressing Q2 earnings.

The rising tide of retail investors, enshrined by the zero-fee trading app known as Robinhood, love this stock, partly because it’s cheap, but digging a bit deeper, there may be reason to for the upside optimism.

The run on MRO stock began on March 9th and went from just over 10,000 Robinhood users piling in to over 206,000 by June 22nd.

Yes, it’s far cheaper to own than, say, ExxonMobil, but it’s more than that, even if the average Robinhood user isn’t delving deeply into company earnings reports.

If oil starts climbing again, there’s a fair amount of upside to be found in this $5 stock.

On August 6th, Marathon released its Q2 earnings report , showing net loss of $750 million or $0.95 per diluted share and an adjusted net loss of $477 million, or $0.60 per diluted share. Net operating cash flow was $9 million ($86 million prior to changes in working capital), and that’s coming up rather short considering that the company spent nearly $140 million on capital projects.

It’s hardly an earnings report worth banking on. But standards these days are low, and what investors should be looking at is the future cash flow potential here.

Marathon has lowered is capex guidance but also raised its oil production guidance for the full year—and it looks set to generate free cash flow at commodity prices significantly below the “current forward curve”, according to CEO Lee Tillman. In other words, they could end up delivering “oil production in line with 4Q2020 at a free cash flow breakeven of approximately $35/bbl.”

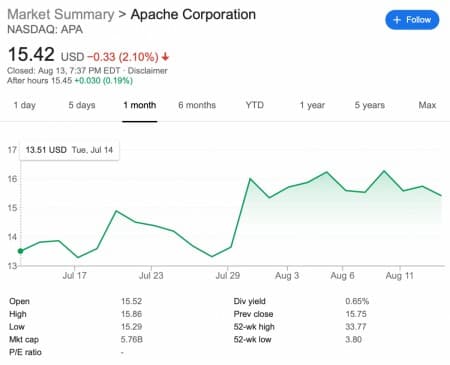

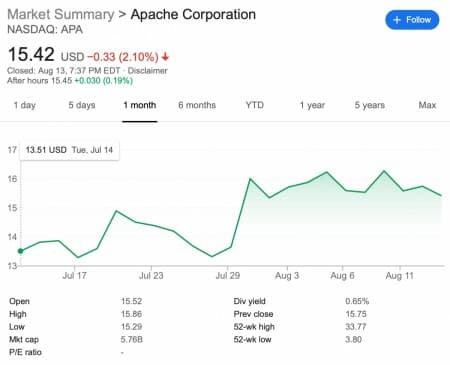

Mid-Cap: Apache Corporation ( NYSE:APA )

It’s been an interesting year for Apache investors, to say the least. Late last year, it fired its iconic VP of worldwide exploration, Steven Keenan after disappointing exploration results offshore Suriname, which was supposed to turn into another wild ride like Exxon’s series of discoveries just across the maritime border in Guyana.

Immediately afterwards, it announced a partnership with French Total SA in Suriname, and then suddenly, they hit a major discovery that would put that country on the hydrocarbons map for the first time. Three discoveries later, and Apache is riding high on this venue.

It helped that right before this, Bank of America Merrill Lunch had told investor that Suriname could end up being a game-changer for Apache, resetting the investment case for the mid-cap one-time shale darling.

It also helped when it came time for Q2 earnings, when Apache reported a 53% drop in revenue year-on year, even though it beat Wall Street expectations by over $43 million. The company also reported quarter-on-quarter production volume declines, with crude volumes sliding 7% and natural gas sliding 8%, though natural gas liquids jumped 12%.

Despite the downturn, Apache still managed to beat other key players in the shale patch—but all eyes are now on Suriname, exactly where they should be. This is history in the making, and the upside is looking good.

Small-Cap: Recon Energy Africa ( TSX.V: RECO , OTCMKTS:LGDOF )

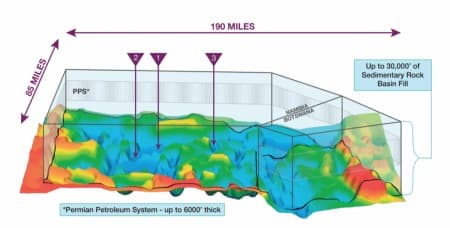

Welcome to the final frontier of oil and gas—and the last possible venue left in the world for major onshore discoveries. More to the point, welcome to a venue that has very high potential to become the world’s next big shale producer, and even bigger than Eagle Ford.

That’s exciting enough on its own, but when you consider that a small-cap company owns the entire basin in a supermajor-trumping move, there’s a lot to look at here.

Recon Energy Africa (RECO) holds the license for the entire Kavango Basin—a 8.5-million acre monolith with a potential 18.2 billion barrels of oil-in-place waiting to be proved up to technical recovery.

Recon’s got a four-year exploration license and a 25-year production license once a commercial discovery is made.

All that is remarkable for a small company with a market cap of around $50 million.

Even that isn’t big enough for ReconAfrica, though: On June 11th , they expanded their position, announcing a new petroleum license covering the Eastern extension for the Deep Kavango Basin and a farm-out option agreement. That new license is northwestern Botswana is for 2.45 million acres and is contiguous to its 6.3-million-acre petroleum license in northeast Namibia.

And now, Recon Africa is fully funded for a 3-well drilling campaign, and acquired its first rig earlier this year. According to the company’s releases they expect to spud the first well in November this year.

They’ve already de-risked extensively by being fully funded to prove the basin up. They managed to raise over CAD$22 million this year in the most successful oil deal of 2020 on the Canadian Venture exchange, thanks to investors who have grasped the potential of this shale deal.

For a small-cap company sitting on a massive basin all by itself and fully funded to drill, the possible upside for investors with a bigger risk appetite is significant.

So, ReconAfrica is about to drill—this year. It’s fully funded to do so, and eyes will be all on this stock towards the end of the year when we can expect to start seeing results from its drill program.

But Recon Africa isn’t the only party interested in Africa’s potential as a new frontier.

Exxon (NYSE:XOM) recently acquired additional 7 million net acres from the Namibian government for a block extending from the shoreline to about 135 miles offshore in water depths up to 13,000 feet, with exploration activities to begin by the end of this year.

What Exxon’s banking on is that Namibia, which once fit together with Brazil, shares the same geology as Brazil’s pre-salt bonanza basins, Santos and Campos, which have already proved enormously resource-rich, according to Deloitte . When oil demand returns to normal, this will put Exxon in a great position to take an edge over its biggest competitors.

Bonus: Diversified Oil Companies:

As one of the biggest names in energy, Suncor Energy (NYSE:SU) has adopted a number of high-tech solutions for finding, pumping, storing, and delivering its resources. Not only is it big in the oil sector, however, it is a leader in renewable energy. Recently, the company invested $300 million in a wind farm located in Alberta.

When the rebound in crude prices finally materializes, giants like Suncor are sure to do well out of it. While many of the oil majors have given up on oil sands production – those who focus on technological advancements in the area have a great long-term outlook. And that upside is further amplified by the fact that it is currently looking particularly under-valued compared to its peers.

Total (NYSE:TOT) maintains a ‘big picture’ outlook across all of its endeavors. It is not only aware of the needs that are not being met by a significant portion of the world’s growing population, it is also hyper-aware of the looming climate crisis if changes are not made. In its push to create a better world for all, it has committed to contributing to each of the United Nations’ Sustainable Development Goals. From workplace safety and diversity to societal progression and reducing its carbon footprint, Total is checking all of the boxes that the next generation of investors hold close to their hearts.

By. Mick Cantle

Oilprice.com