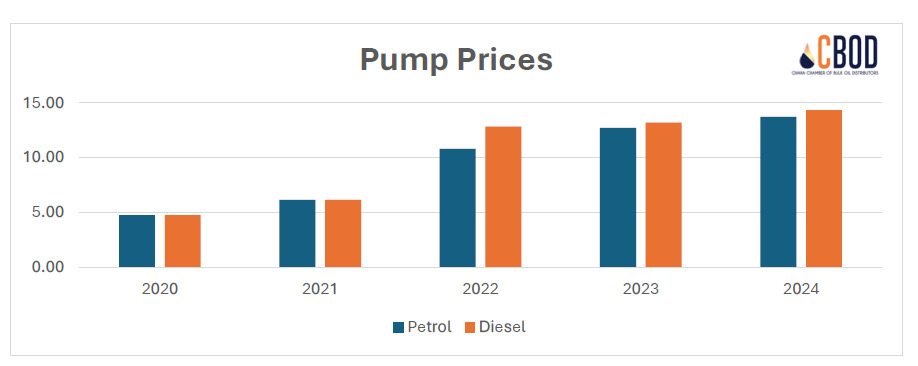

Over the past four years, fuel prices in Ghana have undergone a dramatic surge, affecting households, businesses, and the overall economy. Pump prices for petrol and diesel have risen sharply, with petrol increasing by approximately 150% and diesel by nearly 200% from 2020 to 2024. In 2020, petrol and diesel pump prices averaged below GHS5/Ltr. However, current average pump prices are above GHS13/Ltr for both petrol and diesel. The factors driving these increments are numerous and complex, with the exchange rate playing a central role.

Key Factors Driving the Surge

- Exchange Rate Depreciation

The exchange rate has been the most significant contributor to the rising pump prices in Ghana. The Ghanaian cedi depreciated by a staggering 40.88% against the US dollar in 2024 alone. This sharp depreciation directly impacted the cost of petroleum products, which are imported in US dollars. As a result, petrol and diesel prices at the pumps saw an average increase of about 10% in 2024 compared to 2023. The Bank of Ghana (BoG) in 2022 commenced a special FX auction to BIDECs at relatively lower rates for the importation of petroleum products. The aim of this auction was to increase the accessibility of FX for petroleum products to reduce the escalating impact of the FX rate on pump prices. BoG under the special FX auction to BIDECs currently stands at about USD40 million per month compared to about USD40 million required for petroleum products monthly.

In the latter months of 2024, however, there was a slight appreciation of the cedi against the US dollar, which contributed to a relative stabilisation of pump prices. Despite this, the high prices remain a burden for many Ghanaians, with petrol and diesel prices staying above GHS13 per litre, while LPG soared above GHS15 per kilogram.

- Global Events: Russia-Ukraine War

The ongoing conflict between Russia and Ukraine has had far-reaching implications on global energy markets. Russia, a major oil and gas producer, faced sanctions that disrupted supply chains and led to increased prices on the international market. The EU and US placed sanctions on the exportation of Russian crude and refined petroleum products. On 2 September 2022, the G7 nations also agreed to cap the price of Russian oil to reduce Russia’s ability to finance its war with Ukraine. This situation disrupted the global supply chain and indirectly affected Ghana, as higher crude oil prices translated to increased costs for refined petroleum products.

- COVID-19 Pandemic

The COVID-19 pandemic disrupted global supply chains, leading to significant increases in transportation and production costs. Even as the world began to recover, the lingering effects of the pandemic continued to impact global energy markets, contributing to the high pump prices in Ghana. At the height of the COVID-19 lockdown, freight costs surged significantly impacting the transport of petroleum products to Sub-Saharan Africa.

- Israel-Iran Conflict

Tensions in the Middle East, particularly between Israel and Iran, have also contributed to the volatility of global oil prices. The region remains a critical hub for oil production, and any disruptions or uncertainties invariably lead to price hikes. These global dynamics exacerbate the challenges faced by oil-importing countries like Ghana.

Impact on Households and Businesses

The surge in fuel prices has had widespread implications for the Ghanaian economy. Transportation costs have risen significantly, leading to increased prices of goods and services. Public transportation fares have been adjusted multiple times to reflect the higher pump prices, placing additional financial strain on commuters. In January 2024, The Commercial Transport Operators of Ghana, in a press release, announced a 30% increment in transportation fares. In December 2024, the Transport Operators of Ghana again announced a 15% increase in transport fares due to hikes in pump prices. Furthermore, the sharp rise in LPG prices has affected its adoption by households, many of whom rely on it for cooking and other domestic needs. Data shows that LPG consumption declined from about 345,478 MT in 2021 to 305,076 MT in 2022, mainly due to a hike in LPG pump prices.

Relative Stability in Late 2024

Despite the persistent challenges, the last two months of 2024 brought some relief with the relative stability of pump prices. This stability is attributed to the slight appreciation of the cedi against the US dollar during the period. While this development is promising, it underscores the critical role of exchange rate management in stabilising fuel prices.

Conclusion

The surge in fuel prices from 2020 to 2024 highlights the interconnectedness of global events, exchange rate fluctuations, and local economic policies. As the Ghanaian government and stakeholders work to address these challenges, prioritising exchange rate stability remains essential. Long-term strategies, such as diversifying energy sources and improving local refining capacity, could help mitigate the impact of global and domestic factors on pump prices. In the meantime, households and businesses will need to navigate the economic pressures brought about by the rising cost of fuel.