Crude Oil and Refined Products Market Review and Outlook

During the pricing window under review, international crude oil prices declined by about 6.5%, compared to a 2.0% drop in the preceding window. The reduction was primarily driven by increased production levels among both OPEC and non-OPEC countries, including notable output growth from the United States, Brazil, and Canada. The persistent supply-demand imbalance reflects the market’s structural shift, as energy diversification, efficiency improvements, and the accelerating penetration of electric vehicles (EVs) continue to moderate the demand for fossil fuel.

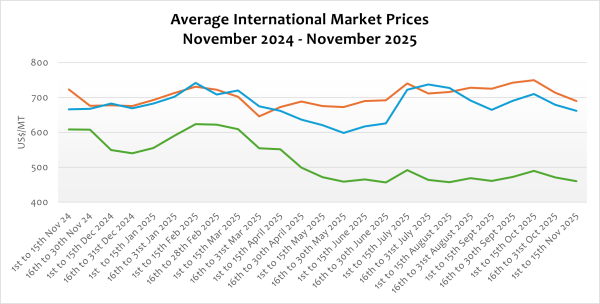

In the refined petroleum products market, international benchmark prices for petrol, diesel, aviation ATK, and LPG fell by approximately 3.3%, 2.5%, 1.6%, and 2.4%, respectively. Specifically, petrol declined from USD 713.35/MT to USD 690.00/MT, while diesel fell from USD 678.95/MT to USD 662.13/MT.

The drop in international petroleum prices shows that the global energy market is changing, with more investment in oil production, slower economic growth, and faster efforts to reduce carbon emissions affecting prices in the near future. In the future, if these trends continue, global supply might become more stable, but demand may not fully recover, meaning that local prices will still depend on how production holds up and how demand changes over time.

For Ghana, these global developments will provide relief in pump prices during the period, supported further by the relative stability and appreciation of the cedi against the U.S. dollar.

FuFeX30 and Spot Rates

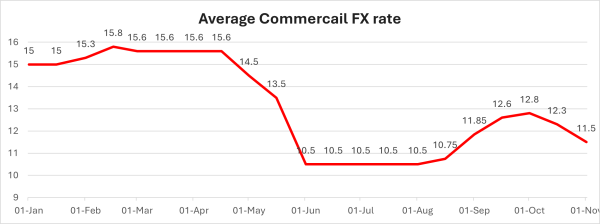

The Fufex30[1] for the first selling window of November (1st to 15th November) is estimated at GHS11.5000/USD, based on quotations from oil financing commercial banks. Moreover, the applicable spot rate for cash sales is estimated at GHS11.2000/USD based on quotations from oil financing commercial banks.

The cedi for the last two months dropped significantly from about GHS10.50/USD in August to about GHS12.80/USD at the end of September. The sharp depreciation was a key driver of the surge in pump prices over the period. However, recent significant intervention by the BoG has stabilised the cedi, resulting in a substantial appreciation of the cedi from the second week of October. This will significantly lower pump prices of petroleum products in the coming window.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 1st to 15th November 2025

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 690.0000 | 662.1200 | 460.0800 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 200 | 200 | 255 |

| Spot FX Rates | 11.2000 | 11.2000 | 11.2000 |

| FuFex30 (GHS/USD) | 11.5000 | 11.5000 | 11.5000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 7.5259/ltr | 8.1591/ltr | 8.0089/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 7.7274/ltr | 8.3777/ltr | 8.2234/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 16th to 31st October 2025 selling window accounted for about 32.55%, 31.91%, and 15.54% of the pump prices of petrol, diesel, and LPG, respectively. This data shows that consumers are overburdened with levies on petroleum products.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY SECTOR SHORTFALL AND DEBT REPAYMENT LEVY | 1.95 | 1.93 | 0.73 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 4.27 | 4.25 | 2.11 |

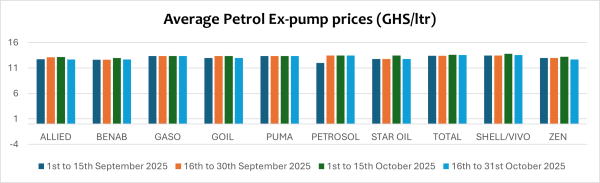

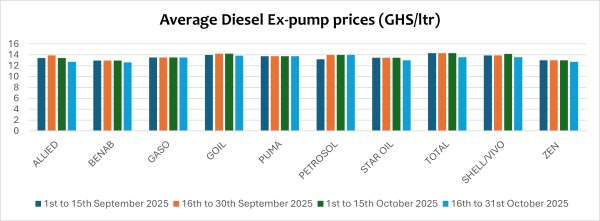

OMC Pricing Performance: 16th to 31st October September 2025

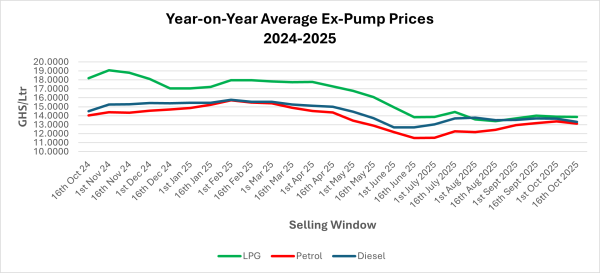

Pump prices of petroleum products declined in the 16th to 31st October pricing window largely due to the combined effects of international market dynamics and domestic currency performance. This underscores the complex interplay between global events and domestic factors, particularly local currency performance, on the pump prices of petroleum products.

The increase in global supply by both OPEC and Non-OPEC countries like, US, Canada, and Brazil, as well as the appreciation of the cedi against the US dollar, resulted in the decline in pump prices. The pump price of petrol fell from about GHS13.3700/Lt to GHS13.1190/Ltr while diesel fell from GHS13.6700/Ltr to GHS13.3190/Ltr within the period. The fall in pump prices will largely impact transport fares and the general economy, especially its impact on inflation.

The average pump price of petrol declined by about 1.88%. The decrease was relatively lower than the decline in the pump price of diesel due to the low stock levels of petrol within the period. On a year-on-year basis, pump prices of petrol are down by 11.82%, while they are down by 6.50% on a year-to-date basis.

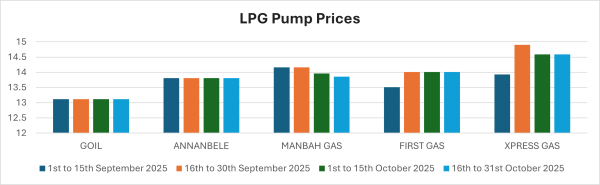

Average pump prices of diesel declined by 2.57% from GHS13.6700/Ltr to GHS13.3190/Ltr due to the significant fall in the international market price of diesel in the period. LPG also declined by 0.14% from an average of GHS13.8980/Kg to GHS13.8780/Ltr due to the decline in the international price of LPG.

Due to the significant decline of refined petroleum product prices on the international market and the notable appreciation of the cedi in the current window compared to the previous window, pump prices are expected to decline in the coming window of 1st to 15th November 2025.

The sustenance of the declining trend will provide relief to consumers and support broader price stability within the economy, especially as global demand softens towards the end of the year. This development also underscores the importance of stabilising the domestic currency.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.