Crude Oil and Refined Products Market Review and Outlook

Global demand for crude oil and petroleum products has surged due to growth in the US and Chinese economies in Q4 2023. The Chinese government provided economic stimulus in the last quarter of 2023, which resulted in growth in the economy. Moreover, the drop in inflation in the US and ongoing geopolitical tensions in the Middle East continue to wedge prices higher. Global macroeconomic indicators show that economic growth fell below expectations in 2023 due to a weak post-COVID-19 recovery and higher inflation and interest rates in Europe and the US. According to Reuters, prices are expected to surge in the coming weeks due to the larger than expected drawdown in US crude stockpiles. Crude oil surged by about 4.1% to USD81.3/bbl in the window under review. This represents a Y-o-Y decline of about 4.5% and a decline of about 14.2% since the first window of October 2023.

The demand for petroleum products has been projected to rise in the first quarter of the year, given the higher-than-expected growth in the US and China. Moreover, Reuters predicts that the US central bank will begin to cut down its interest rate, which will further raise demand for crude and petroleum products.

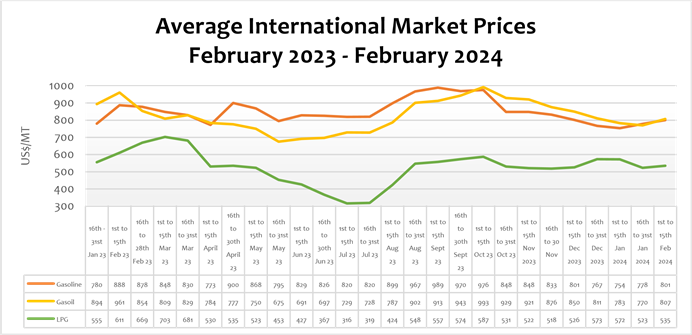

The international market price of all major petroleum products surged in the window under review. Petrol, diesel, and LPG surged by 2.9%, 4.8%, and 2.4%, respectively. Compared to the same period last year, petrol, diesel, and LPG prices declined by 9.2%, 16.6%, and 12.4%, respectively. On a y-t-d basis, while the international market price of petrol and diesel surged by 6.3% and 3.1%, respectively, LPG declined by 6.5%.

FuFeX30 and Spot Rates

The Fufex30[1] for the first selling window of February (1st to 15th February 2024) is estimated at GHS12.5000/USD, while the applicable spot rate for cash sales is GHS12.4000/USD based on quotations received from oil financing commercial banks.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 16th – 31st October 2023 | 20% | 11.6435 |

| 1st – 15th November 2023 | 21% | 11.6824 |

| 16th – 30th November 2023 | 21% | 11.9131 |

| 1st to 15th December 2023 | 19% | 11.9131 |

| 16th to 31st December 2024 | 29% | 12.1512 |

| 1st to 15th January 2024 | 19% | 12.1497 |

| 16th to 31st January 2024 | 31% | 12.1369 |

The BoG’s bi-weekly FX auction to BIDECs in the 16th to 31st January 2024 pricing window for the purchase of petroleum products was US$20 million, representing 31% of BIDECs’ bid. The FX rate auctioned by BoG to BIDECs was GHS12.1369/USD, representing an appreciation of 0.11% compared to the previous window. The BOG auction rate from January to December 2023 depreciated by 28%.

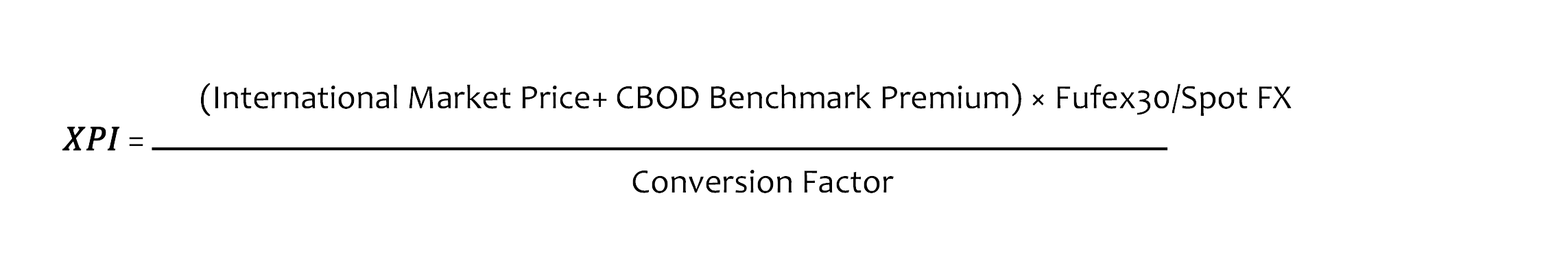

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given

window, and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 1st to 15th February 2024

Price Component Petrol Diesel LPG

| Average World Market Price (US$/mt) | 800.8400 | 807.1400 | 535.4100 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 120 | 120 | 180 |

| Spot FX Rates | 12.4000 | 12.4000 | 12.4000 |

| FuFex30 (GHS/USD) | 12.5000 | 12.5000 | 12.5000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 8.6209/ltr | 9.7146/ltr | 8.8711/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 8.6904/ltr | 9.7929/ltr | 8.9426/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 16th to 31st January 2024 selling window accounted for 25%, 23%, and 15% of the ex-pump prices of petrol, diesel, and LPG, respectively.

| TRM Components | Gasoline (GHS/ltr) | Gasoil (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.13 | 0.13 | – |

| BOST MARGIN | 0.09 | 0.09 | – |

| FUEL MARKING MARGIN | 0.5 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.75 | 0.75 | 0.75 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 2.96 | 2.94 | 2.01 |

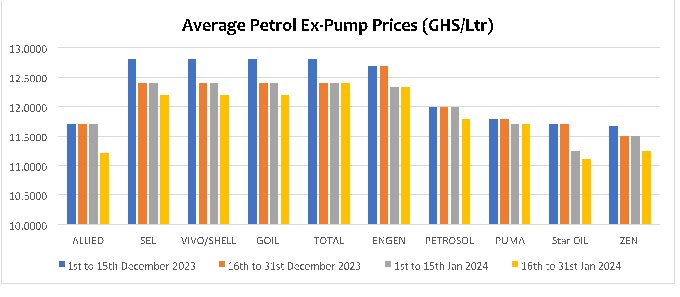

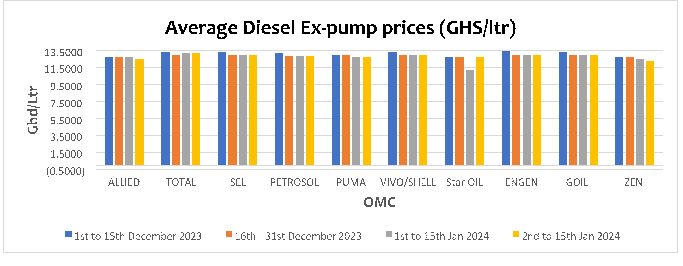

OMC Pricing Performance: 16th to 31st January 2024

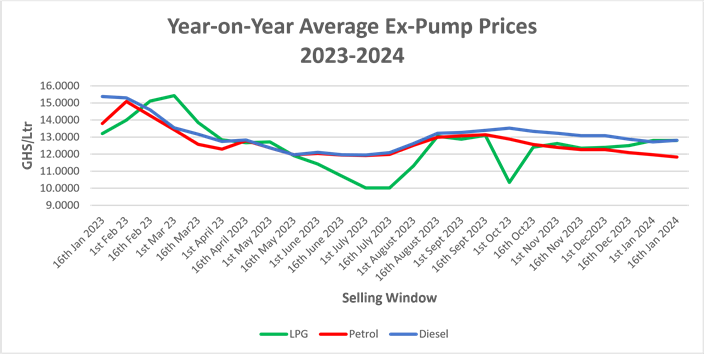

The average pump prices of petroleum products for the 16th to 31st January 2024 (the second selling window of the year) declined for petrol and surged marginally for diesel compared to the previous window. Although the price of petrol on the international market rose by about 3% while diesel declined by about 2%, the slight depreciation of the Cedi largely influenced the change in pump prices.

Pump prices of petrol within the period declined by about 1.4% to GHS 11.8320/Ltr. This was mainly due to the appreciation of the cedi against the dollar within the period, although global prices rose by about 3%.

On a y-o-y basis, petrol pump prices declined by about 14.3%.

Unlike the pump price of petrol, diesel prices surged by about 0.9% to an average of GHS12.8080/ltr in the 16th to 31st January 2024. On a year-on-year basis, pump prices for diesel declined by about 16.7%. This rise is attributed to international market factors, as the Cedi/USD exchange rate appreciated slightly in the period under review.

Pump prices of petrol and diesel are expected to rise in the coming window due to the weakening of the Cedi against the US Dollar in the last window of January and the surge in international market prices.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.