Crude Oil and Refined Products Market Review and Outlook

Crude oil prices on the global market declined by approximately 2.40% during the 12th to 26th November pricing window. This drop occurred despite stronger demand in China and improved market sentiment following the U.S.–China tariff agreement, as concerns about oversupply from both OPEC and non-OPEC producers continued to weigh on the market. According to the IEA’s November Oil Market Report “Global oil supply was nevertheless up by a massive 6.2 mb/d since January, with gains divided evenly between non-OPEC+ and OPEC+. World oil supply is set to rise by 3.1 mb/d in 2025 and 2.5 mb/d in 2026 on average to reach 108.7 mb/d”.

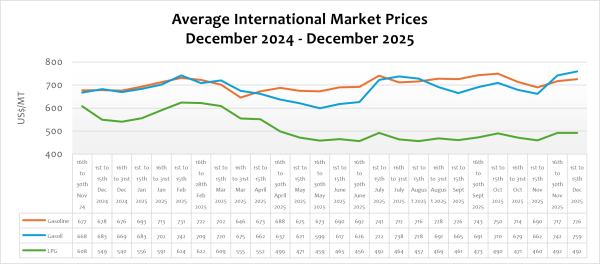

The refined petroleum product space witnessed international prices rising within the period by about 1.26% and 2.28% respectively for petrol and diesel. The upward trend was largely driven by positive market sentiment following the tariff agreement between the United States and China, improved economic demand in China, and the impact of the U.S. sanctions on Russian crude exports.

We anticipate that global crude oil and refined product prices will maintain a moderately bullish trajectory, supported by steady demand from key Asian markets and persistent geopolitical tensions, particularly the ongoing Russia–Ukraine conflict. Nonetheless, expected increases in supply from both OPEC and non-OPEC producers, along with seasonal demand slowdowns in certain regions, could cap any significant upward movement in prices.

Additionally, we project a slight deceleration in global demand growth for crude and petroleum products in December. This is influenced by the winter season in Europe and North America, as well as the continued rise in electric vehicle (EV) adoption driven predominantly by China. This expanding EV uptake is expected to soften medium-term demand and place downward pressure on global oil prices.

FuFeX30 and Spot Rates

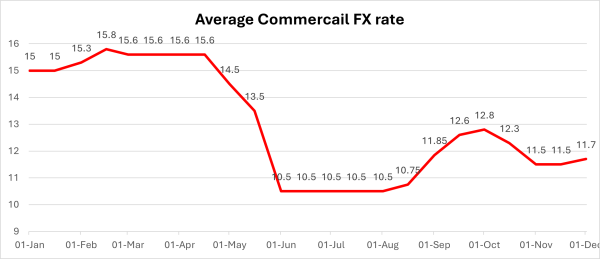

The Fufex30[1] for the first selling window of December (1st to 15th December) is estimated at GHS11.7000/USD, based on quotations from oil financing commercial banks. Moreover, the applicable spot rate for cash sales is estimated at GHS11.4000/USD based on quotations from oil financing commercial banks.

Although the cedi depreciated significantly from September to October, it appreciated considerably against the USD in November, leading to the decline in pump prices experienced in the first window of November. It is expected that the cedi will continue to hold strongly against the USD in December.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 1st to 15th December 2025

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 725.6400 | 759.3000 | 492.4800 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 200 | 200 | 255 |

| Spot FX Rates | 11.4000 | 11.4000 | 11.4000 |

| FuFex30 (GHS/USD) | 11.7000 | 11.7000 | 11.7000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 7.9670/ltr | 9.2410/ltr | 8.5213/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 8.1767/ltr | 9.4841/ltr | 8.7455/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 16th to 30th November 2025 selling window account for about 34.69%, 33.46%, and 16.37% of the ex-pump prices of petrol, diesel, and LPG, respectively. This shows that consumers are overburdened with levies on petroleum products.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY SECTOR SHORTFALL AND DEBT REPAYMENT LEVY | 1.95 | 1.93 | 0.73 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 4.27 | 4.25 | 2.11 |

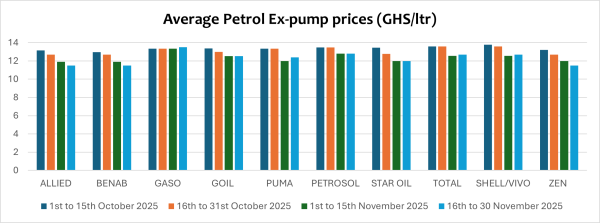

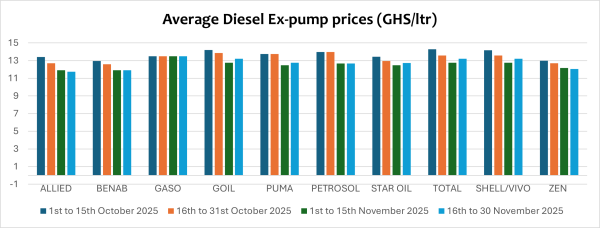

OMC Pricing Performance: 16th to 30th November 2025

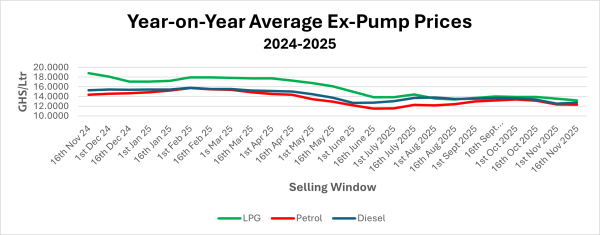

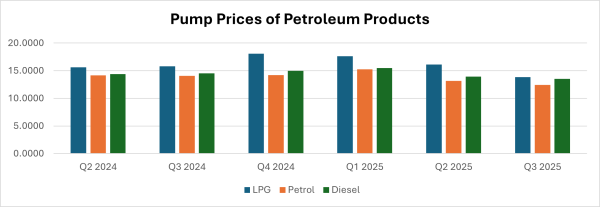

Pump prices of petroleum products have generally been on the decline since January 2025, although prices rose slightly in June and July due to the abrupt surge in international prices occasioned by the Israel-Iran conflict within the period. The 16th to 30th November pricing window saw a slight rise in the price of Diesel, while LPG declined marginally. The decline was due to the combined effects of international market dynamics and domestic currency performance. This underscores the complex interplay between global events and domestic factors, particularly local currency performance, on the pump prices of petroleum products.

The increase in global crude supply from both OPEC and non-OPEC producers, particularly the United States, Canada, and Brazil, coupled with the appreciation of the Ghana cedi against the US dollar, contributed to a decline in domestic pump prices during the review period.

Petrol pump prices fell below GHS11/Ltr at some OMCs, mainly due to the impact of the FX rate and international prices. On a year-on-year basis, pump prices of petrol are down by 14.30% and down by 17.20% on a year-to-date basis.

Average pump prices of diesel increased by an average of 1.29%, with some OMCs selling below GHS12/Ltr and others above GHS13/Ltr. LPG also declined by 2.39% from an average of GHS13.5460/kg to GHS13.1360/kg due to the decline in the international price of LPG.

The rise in international crude and refined product prices, combined with the appreciation of the cedi against the U.S. dollar during the second half of November, resulted in a slight reduction in pump prices of petrol and LPG in the 1st to 15th November 2025 pricing window. However, with the recent uptick in international market prices and the slight depreciation of the cedi within the current pricing window, pump prices are projected to rise in the upcoming window of 1st to 15th December 2025.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.