Crude Oil and Refined Products Market Review and Outlook

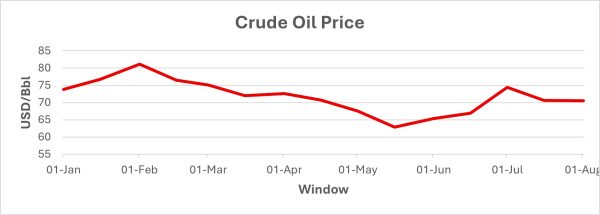

Heightened geopolitical tensions and hikes in supply-risk premiums resulted in a temporary surge in crude oil prices in June by about 13%. This was largely due to the impact of the Israel–Iran conflict that resulted in the Parliament of Iran threatening the closure of the Strait of Hormuz, which accounts for about 20% of the world’s crude oil loading. The Strait is a narrow channel approximately 30 miles wide between the Omani Musandam Peninsula and Iran; it connects the Persian Gulf to the Gulf of Oman. According to Reuters news, the Strait is the world’s busiest oil shipping channel, responsible for about 1/5 of global oil and gas flows through the Gulf.

However, the price of crude and refined petroleum products resumed trending downwards in July after the two countries agreed to a ceasefire. Global crude prices have been on a downward trajectory since the third Quarter (Q3) of 2024 due to the uncertainties in the global economy introduced by the US–China tariff war, slower than expected covid-19 recovery, and increasing global production. According to OPEC+, persistent concerns over the trajectory of US–China trade negotiations capped upward momentum. Reuters news also reports that the OPEC+ nations agreed at a meeting in the first week of July to raise production by 548,000 barrels per day (bpd) in August, up from the 411,000 bpd the group had approved for May, June, and July and 138,000 bpd for April. This production boost is expected to come from Saudi Arabia, Russia, the United Arab Emirates, Kuwait, Oman, Iraq, Kazakhstan, and Algeria.

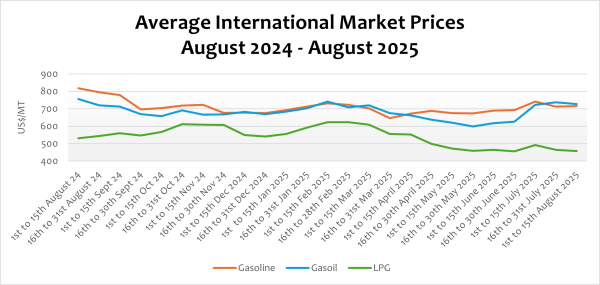

The international prices of refined petroleum products, including diesel and LPG, declined by 1.33% and 1.53%, respectively, while petrol and kerosene rose by 0.54% and 2.47%, respectively. It is expected that as the OPEC+ nations increase their production as indicated, crude and petroleum prices on the global market will decline in the coming months.

FuFeX30 and Spot Rates

The Fufex30[1] for the first selling window of August (1st to 15th August) is estimated at GHS11.0000/USD, while the applicable spot rate for cash sales is GHS10.5000/USD based on quotations received from oil financing commercial banks.

The Ghana Cedi recorded significant performance in the first seven months of the year due to the prudent government fiscal policies and proactive monetary policies by the central bank. Available data shows that the cedi has appreciated by over 30% since January 2025.

As part of efforts to improve forex supply to BIDECs for the importation of petroleum products, the BOG is currently restructuring the bi-weekly auction to BIDECs. Under this new approach, BIDECS will be required to participate in an auction through their various commercial banks.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 1st to 15th August 2025

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 715.8000 | 727.6800 | 456.9500 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 200 | 200 | 255 |

| Spot FX Rates | 10.5000 | 10.5000 | 10.5000 |

| FuFex30 (GHS/USD) | 11.0000 | 11.0000 | 11.0000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 7.2600/ltr | 8.2309/ltr | 7.4755/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 7.6057/ltr | 8.6228/ltr | 7.8315/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 16th to 31st July 2025 selling window increased from 28.36%, 24.92%, and 15.23% of the ex-pump prices of petrol, diesel, and LPG, respectively, to 34.81% and 31.00% for petrol and diesel, respectively, due to the implementation of the GHS1/Ltr levy.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY SECTOR SHORTFALL AND DEBT REPAYMENT LEVY | 1.95 | 1.93 | 0.73 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 4.27 | 4.25 | 2.11 |

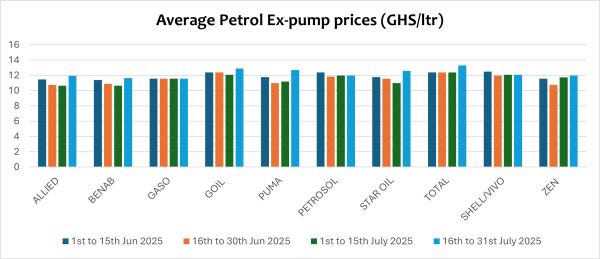

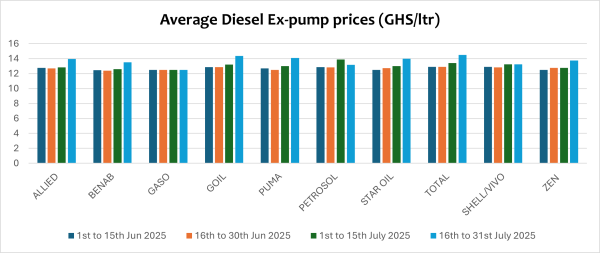

OMC Pricing Performance: 16th to 31st July 2025

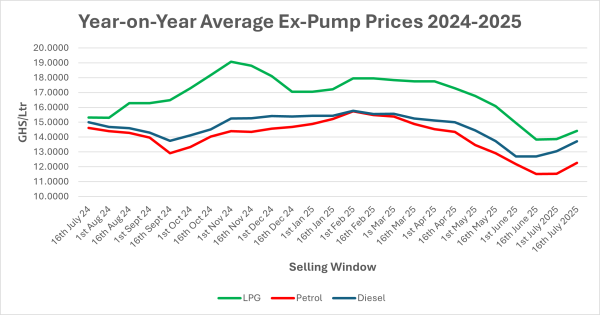

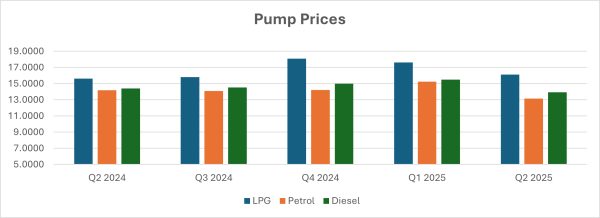

Although pump prices of petroleum products (petrol, diesel, and LPG) have been witnessing significant declines since the beginning of the year, the window under review witnessed a surge in pump prices due to the implementation of the Energy Sector Shortfall and Debt Repayment Levy (GHS1.00 Levy).

Pump prices of petroleum products have been declining in recent times due to the appreciation of the Cedi and the decline in global prices of petroleum and crude oil. The Bulk Import Distribution and Exports Companies (BIDECs), the importers of petroleum products in the country, have attributed the declining pump prices to government efforts in maintaining the stability of the cedi in recent times. Although there has been a decline in crude oil prices since the beginning of the year, partly accounting for the decline in pump prices, the plummeting pump prices are largely attributed to the appreciation of the cedi.

For the first time since October 2022, pump prices have fallen below GHS11/Ltr in July due to the appreciation of the cedi. Pump prices escalated significantly in November 2022 when the GHS/USD exchange rate rose from about GHS9 to about GHS15 per USD, leading to a surge in pump prices of petrol and diesel to about GHS18/Ltr and GHS23/Ltr, respectively. Pump prices have been on the high side since then, selling above GHS14/Ltr. However, the recent appreciation of the cedi has led to a significant decline in pump prices. The Cedi, which was trading at about GHS14.85/USD in January this year, has appreciated significantly, currently trading at about GHS10.50/USD by the commercial banks as of 30th July 2025.

Moreover, crude oil prices on the global market declined by about 10% in Q2 compared to Q1 and about 16% compared to the same period last year, leading to declining pump prices. The decline in global prices has been attributed to increased global crude production and weak global economic growth.

Due to the performance of these factors, which are the main determinants of pump prices, petrol, diesel, and LPG pump prices have declined significantly since January by 17.55%, 11.21%, and 15.46%, respectively. The figure above shows the sharp decline in pump prices from Q4 2024 to Q2 2025. However, the implementation of the Energy Sector Shortfall and Debt Repayment Levy (GHS1.00 Levy) led to the rise in the pump prices of petrol, diesel, and LPG in the pricing window under review.

In the window under review, petrol rose by 3.63% due to the implementation of the Levy. Average prices of Petrol at the pumps are down by 16.10% on a year-on-year basis. The average pump prices of diesel and LPG rose by 5.12% and 4.01%, respectively, and declined by 8.6% and 5.91% on a year-on-year basis, respectively.

As the Israel-Iran conflict is currently under ceasefire, global prices of crude and petroleum products have begun to decline. The spike in international prices in June due to the retaliatory attacks between Israel and Iran is currently reversing due to the truce agreement. It is expected that pump prices will remain unchanged in the coming window of 1st to 15th August 2025 due to the government’s implementation of the GHS1/Ltr levy on petrol and diesel pump prices. Pump prices of local Marine gasoil is also expected to rise due to the removal of the government subsidy as announced by the Minister of Finance at the mid-year budget review.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.