Refined Products Review and Outlook

Crude oil output rose by about 270,000 b/d in September due to higher production from some OPEC+ nations such as Nigeria and Kazakhstan. Despite the continual cut in production by Russia and Saudi Arabia to influence global prices, world crude output rose to about 101.6 million b/d in September 2023.

Due to the quantum increase in production by Nigeria and Kazakhstan among other factors, crude oil prices declined by about 2.17% relative to the previous window. According to the IEA October Oil Market Report, global demand declined slightly in September largely due to a decline in US gasoline consumption. The third quarter witnessed a significant surge in global demand buoyed by the post-pandemic recovery in China and economic growth in India and Brazil. The IEA projects that OPEC+ production will decline considerably in 2023, but the impact of such a decline will be counteracted by production from the US and Brazil.

Supply of crude in 2023 is projected to increase by 1.5 million b/d driven by some non-OPEC+ nations such as the US, Iran, and Brazil.

Global refinery margins declined sharply at the end of Q3 due to a fall in gasoline and fuel oil cracks. According to the IEA, global refinery throughput rose to a summer peak of 83.6 million b/d in August and is expected to decline in Q4. This will likely have an impact on the international price of petrol in the last quarter of the year.

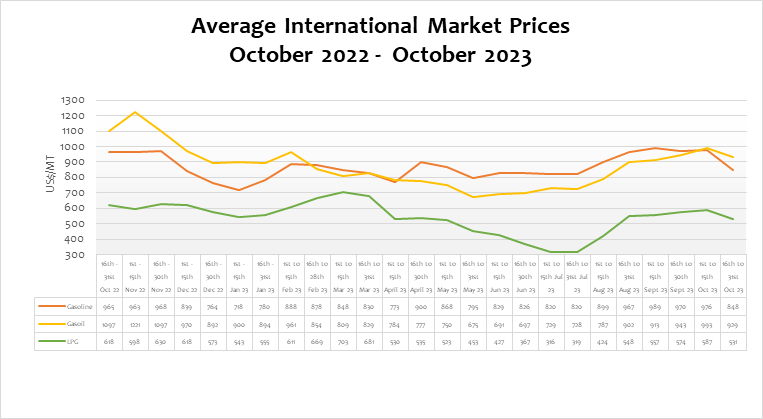

The global price of refined petroleum products declined by about 13.1%,6.4%, and 9.7% for petrol, diesel, and LPG respectively. Compared to the same period last year, petrol, diesel, and LPG declined by 12.1%, 15.3%, and 14.2% respectively. On a year-to-date basis, while the international market price of Petrol and Diesel rose by 18.2% and 3.2% respectively, LPG declined by 2.3%.

FuFeX30 And Spot Rates

The Fufex30[1] for the Second selling window of September (16th to 31st October 2023) is estimated at GHS12.1000/USD, while the applicable spot rate for cash sales is GHS11.9000/USD based on quotations received from oil financing commercial banks.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 1st – 15th April 2023 | 20% | 12.0000 |

| 16th – 30th April 2023 | 24% | 11.4467 |

| 1st – 15th May 2023 | 20% | 11.7575 |

| 16th – 31st May 2023 | 26% | 11.6943 |

| 1st – 15th June 2023 | 39% | 11.1657 |

| 16th – 30th June 2023 | 33% | 11.1781 |

| 1st – 15th July 2023 | 25% | 11.3737 |

| 16th – 31st July 2023 | 30% | 11.3737 |

| 1st – 15th August 2023 | 27% | 11.3312 |

| 16th – 31st August 2023 | 30% | 11.3460 |

| 16th – 30th September 2023 | 22% | 11.4232 |

| 1st – 15th October 2023 | 20% | 11.6435 |

[1] The Fufex30 is a 30-day Ghs/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

The BoG’s bi-weekly FX auction to BIDECs in the 1st to 15th October 2023 pricing window for the purchase of petroleum products was US$20 million, representing 20% of BIDECs’ bid. The FX rate auctioned by BoG to BIDECs was GHS11.6435/USD – a depreciation of 1.9% compared to the previous auction rate.

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th October selling window accounted for 23%, 22%, and 15% of the ex-pump prices of petrol, diesel, and LPG respectively.

| TRM Components | Gasoline (GHS/ltr) | Gasoil (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.13 | 0.13 | – |

| BOST MARGIN | 0.09 | 0.09 | – |

| FUEL MARKING MARGIN | 0.5 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.75 | 0.75 | 0.75 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 2.96 | 2.94 | 2.01 |

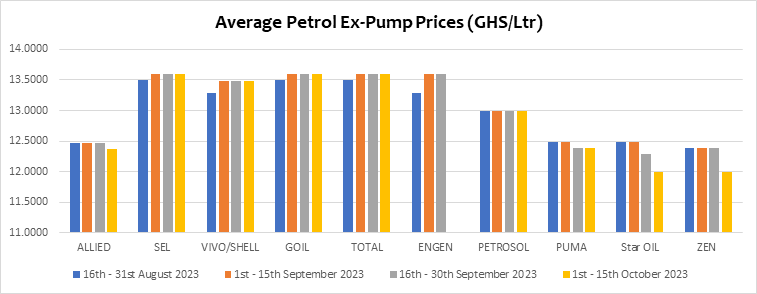

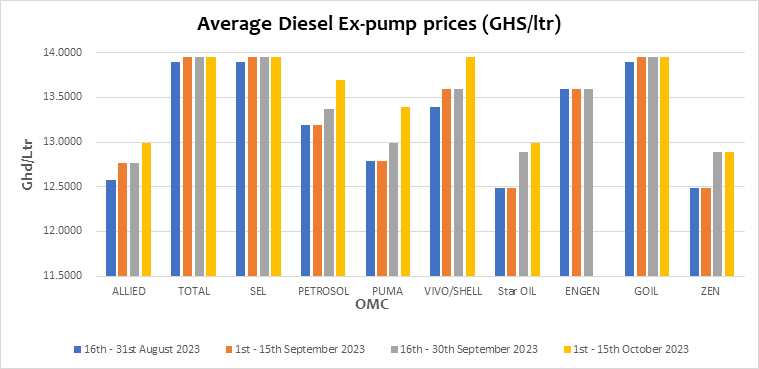

OMC Pricing Performance: 1st to 15th October 2023

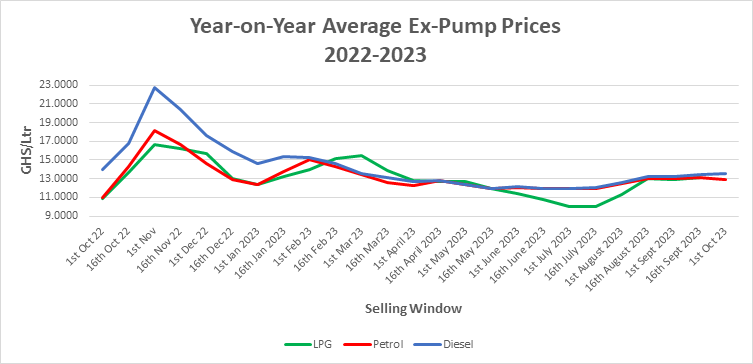

Petroleum product prices at the pumps have been rising since the second selling window of May due to the continual surge in global crude prices. Crude prices rose from about USD82.32/bbl in the first quarter of 2023 to about USD94.76/bbl at the end of September 2023. Major factors that are contributing to the surge in global crude prices include the significant cut in production by OPEC+, a fall in crude inventories, mild post-COVID economic recovery in China, and increasing demand for Jet fuels. These factors are expected to result in global demand outpacing supply by about 1.24 million b/d in the second half of 2023.

Although the relative stability of the Cedi/USD exchange rate in the third quarter was expected to counteract the impact of increases in crude prices internationally, prices at the pumps surged due to the relatively significant rise in international petroleum product prices. According to some industry experts, the US oil demand is expected to increase to record highs in Q4 due to surging consumer purchasing power. Moreover, gasoline and jet fuel demand in China has also increased beyond expectations largely due to the resumption of economic activities after the Covid shutdowns. The continued supply tightness amidst the surging demand for petroleum and petroleum products will further increase pump prices of petroleum products through to the end of the year.

Pump prices of petrol rose marginally by about 1.1% from an average of GHS13.0400/Ltr to GHS12.8011/Ltr in the first selling window of October. This was mainly due to the decline in global prices. On a y-o-y basis, petrol pump prices rose by about 18% while on a y-t-d basis, they rose by 4%. This rising trend is expected to continue throughout Q4 as Saudi Arabia and Russia resolve to maintain their decision to cut production through to the end of the year. According to IEA, gasoline consumption in the US declined in September to two-decade lows.

Unlike the pump price of petrol, diesel prices rose marginally by about 1.1% from an average of GHS13.3940/ltr to GHS13.25278/ltr in the 1st to 15th October 2023 selling window. On a year-on-year basis, pump prices of diesel declined by about 3% and 7% year-to-date basis. From the second selling window of June to the current pricing window, diesel pump prices have risen by about 12%. This rise is attributed to international market factors as the Cedi/USD exchange rate remained steady throughout Q3.

With the decline in global prices of refined petroleum products and the slight depreciation of the cedi, pump prices of petrol, diesel, and LPG are expected to decline slighly by about 10%, 4%, and 5% respectively in the second selling window of October 2023.

Expected Cargoes in Week 41 (9th – 13th October 2023)

A total of about 228.9 million liters of refined petroleum products are expected this week. These comprise 92.2 million liters of diesel and 136.7 million liters of petrol.

Atuabo Gas Processing Plant

The Gas Processing Plant (GPP) at Atuabo is currently producing LPG at an average rate of about 150.474MT/day.