Refined Products Review and Outlook

Crude and petroleum prices on the global market have declined significantly so far in November compared to prices in Q3. The decline has been attributed to a significant rise in the US crude stocks by about 11.9 million barrels in the first week of November and a decline in Chinese oil demand. Despite the sentiments that the Israel–Hamas war in the Gaza Strip might escalate to other parts of the Middle East, crude prices declined by about 5.5% to about USD86.68/bbl. According to Reuters, crude prices are seeing a downturn due to the weak global economic data that have overshadowed the concerns that the Israel-Hamas war could escalate into a broader regional conflict and lead potentially to higher prices.

Data from China’s Bureau of Statistics show that although China’s crude oil import rose in October, the country’s overall exports declined more than expected, indicating a slowing global demand.

According to Reuters Chinese economic data indicate that the world’s second-largest economy recorded a 6.4% drop in export earnings in October 2023. This indicates that as global demand shrinks, China’s exports have fallen considerably for six consecutive months due to rising global interest rates. Reuters maintains that recent growth indicators from the European Central Bank suggest that Europe’s manufacturing and service activities declined marginally in September and October, suppressing the demand for petroleum products. These notwithstanding, the International Energy Agency (IEA) has raised its demand growth forecasts for 2023 to 2.4 million bpd from 2.3 million bpd.

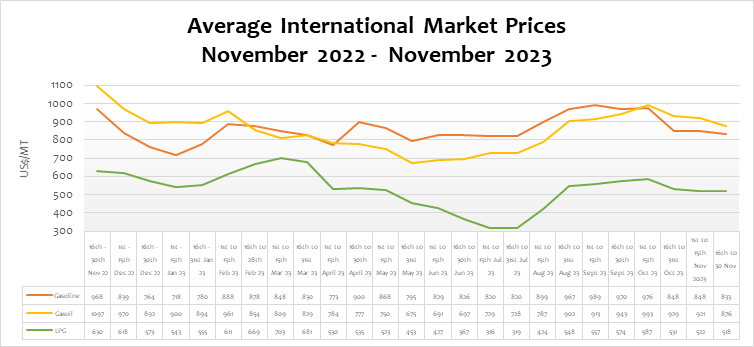

The international market prices of Petrol, Diesel, and LPG declined by 1.8%, 4.8%, and 0.67% respectively. Compared to the same period last year, Petrol, Diesel, and LPG prices declined by 14.0%, 20.1%, and 17.8% respectively. On a year-to-date basis, while the international market price of Petrol rose by 22.0%, Diesel and LPG declined by 2.7% and 4.6% respectively.

FuFeX30 And Spot Rates

The Fufex30[1] for the Second selling window of November (16th to 30th November 2023) is estimated at GHS12.3000/USD, while the applicable spot rate for cash sales is GHS12.2000/USD based on quotations received from oil financing commercial banks.

[1] The Fufex30 is a 30-day Ghs/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 16th – 30th April 2023 | 24% | 11.4467 |

| 1st – 15th May 2023 | 20% | 11.7575 |

| 16th – 31st May 2023 | 26% | 11.6943 |

| 1st – 15th June 2023 | 39% | 11.1657 |

| 16th – 30th June 2023 | 33% | 11.1781 |

| 1st – 15th July 2023 | 25% | 11.3737 |

| 16th – 31st July 2023 | 30% | 11.3737 |

| 1st – 15th August 2023 | 27% | 11.3312 |

| 16th – 31st August 2023 | 30% | 11.3460 |

| 16th – 30th September 2023 | 22% | 11.4232 |

| 16th – 31st October 2023 | 20% | 11.6435 |

| 1st – 5th November 2023 | 21% | 11.6824 |

[1] The Fufex30 is a 30-day Ghs/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

The BoG’s bi-weekly FX auction to BIDECs in the 1st to 15th November 2023 pricing window for the purchase of petroleum products was US$20 million, representing 21% of BIDECs’ bid. The FX rate auctioned by BoG to BIDECs was GHS11.6824/USD, representing a depreciation of 0.33% compared to the previous auction rate.

Ex-ref Price Effective 16th to 30th November 2023

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 832.6400 | 876.1800 | 518.1400 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 120 | 120 | 180 |

| Spot FX Rates | 12.2000 | 12.2000 | 12.2000 |

| FuFex30 (GHS/USD) | 12.3000 | 12.3000 | 12.3000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 8.7748/ltr | 10.2648/ltr | 8.5173/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 8.8467/ltr | 10.3538/ltr | 8.5871/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th November selling window accounted for 24%, 22%, and 15% of the ex-pump prices of petrol, diesel, and LPG respectively.

| TRM Components | Gasoline (GHS/ltr) | Gasoil (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.13 | 0.13 | – |

| BOST MARGIN | 0.09 | 0.09 | – |

| FUEL MARKING MARGIN | 0.5 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.75 | 0.75 | 0.75 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 2.96 | 2.94 | 2.01 |

OMC Pricing Performance: 1st to 15th November 2023

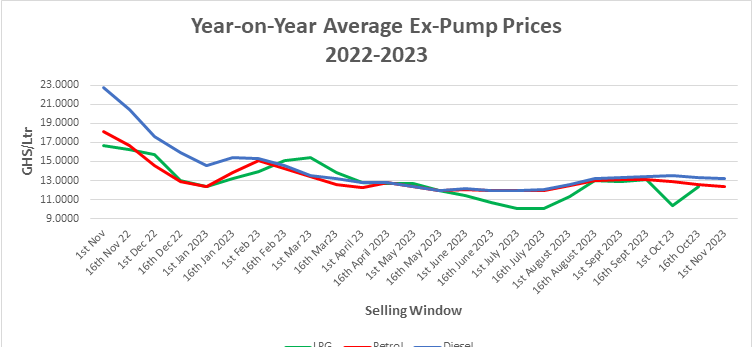

Prices of petroleum products at the pumps further declined marginally in the 1st to 15th November 2023 pricing window. The decline in the prices was mainly attributed to a decline in global prices in the 12th to 26th October 2023 international pricing window. The demand for crude and petroleum products slumped within the period due to a decline in global demand.

Crude prices rose significantly from about USD82.32/bbl in the first quarter of 2023 to about USD94.76/bbl at the end of September 2023. However, the price declined to about USD86.68/bbl in November. Notwithstanding, the IEA has projected demand to surge due to the significant cut in crude production by OPEC+, the fall in crude inventories, mild post-COVID economic recovery in China, and increasing demand for Jet fuels. According to Reuters, China’s economic activity perked up in October as industrial output increased faster and retail sales growth beat expectations, an encouraging sign for the world’s second-largest economy. These factors are expected to result in global demand outpacing supply by about 1.24 million b/d before the end of the year 2023.

The performance of the Cedi/USD exchange rate also depreciated relatively in the selling window under review by about 5 percent. This resulted in a decline in pump prices by about 2 percent. Furthermore, fuel prices are expected to rise going into the end of the year due to the expected depreciation of the Cedi in Q4 as a result of the usual increase in corporate demand for foreign exchange getting to the end of the year.

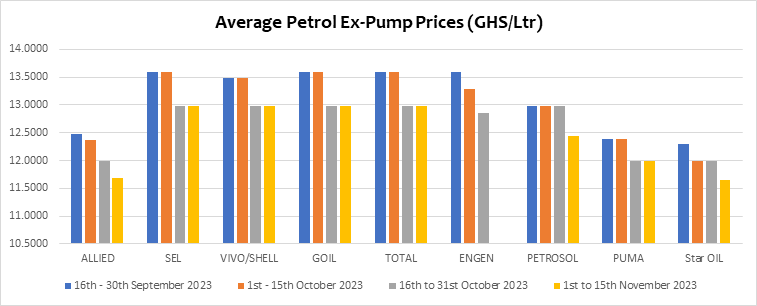

Pump prices of Petrol declined by about 1.4% from an average of GHS12.5760/Ltr to GHS12.3978/Ltr in the first selling window of November. This was mainly due to the decline in global prices. On a y-o-y basis, Petrol pump prices declined by about 31.6% while on a y-t-d basis, they rose by 0.3%. This declining trend is expected to reverse going into December as Saudi Arabia and Russia resolve to maintain their decision to cut production through to the end of the year, increasing global prices of petroleum products.

| Average Petrol Ex-pump prices (GHS/ltr) | |||

| OMC | 16th to 31st October 2023 | 1st to 15th November 2023 | % Change |

| ALLIED | 11.9900 | 11.6900 | -2.5% |

| SEL | 12.9900 | 12.9900 | 0.0% |

| VIVO/SHELL | 12.9900 | 12.9900 | 0.0% |

| GOIL | 12.9900 | 12.9900 | 0.0% |

| TOTAL | 12.9900 | 12.9900 | 0.0% |

| ENGEN | 12.8500 | -100.0% | |

| PETROSOL | 12.9900 | 12.4500 | -4.2% |

| PUMA | 11.9900 | 11.9900 | 0.0% |

| Star OIL | 11.9900 | 11.6500 | -2.8% |

| ZEN | 11.9900 | 11.8400 | -1.3% |

| AVERAGE | 12.5760 | 12.3978 | -1.4% |

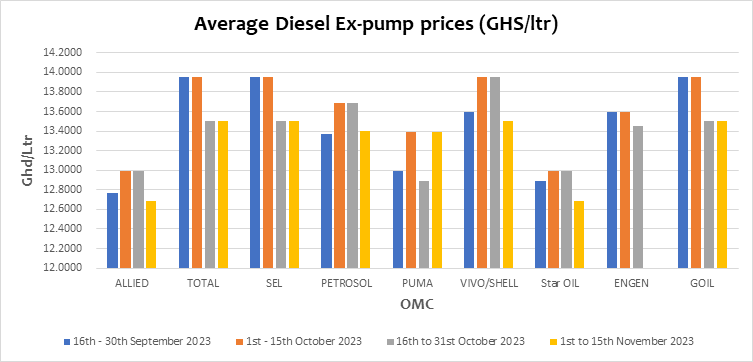

Similar to the pump price of Petrol, Diesel prices declined marginally by about 0.9% from an average of GHS13.4400/ltr to GHS13.2233/ltr in the 1st to 15th November 2023 selling window. On a year-on-year basis, pump prices of Diesel declined by about 41.8% and 9.5% year-to-date. From the second selling window of June to the current pricing window, Diesel pump prices have risen by about 11%. This rise is attributed to international market factors as the Cedi/USD exchange rate remained steady throughout Q3.

| Average Diesel Ex-pump prices (GHS/ltr) | |||

| OMC | 16th to 31st October 2023 | 1st to 15th November 2023 | % Change |

| ALLIED | 12.9900 | 12.6900 | -2.3% |

| TOTAL | 13.5000 | 13.5000 | 0.0% |

| SEL | 13.5000 | 13.5000 | 0.0% |

| PETROSOL | 13.6900 | 13.4000 | -2.1% |

| PUMA | 12.8900 | 13.3900 | 3.9% |

| VIVO/SHELL | 13.9500 | 13.5000 | -3.2% |

| Star OIL | 12.9900 | 12.6900 | -2.3% |

| ENGEN | 13.4500 | -100.0% | |

| GOIL | 13.5000 | 13.5000 | 0.0% |

| ZEN | 12.9800 | 12.8400 | -1.1% |

| AVERAGE | 13.3440 | 13.2233 | -0.9% |

With the decline in global prices of refined petroleum products and the appreciation of the cedi, pump prices of Petrol, Diesel, and LPG are expected to slightly decline by about 1%, 2%, and 1% respectively in the Second selling window of November 2023.

Weekly Petroleum Stock

The total petroleum stock available in the country at the beginning of the week, Monday 13th November 2023, comprised Petrol, Diesel, LPG, ATK, Kerosene, Premix, and RFO. The breakdown of the total stocks and expected weekly consumption in the country is presented in the table below.

|

Product |

Total Stocks (Million Ltrs) |

Forecasted Weekly

Consumption (Million Ltrs) |

Week-to-Last |

Cargoes at anchorage (Million Ltrs) | Week-to-Last including cargoes at anchorage |

| Diesel | 244.4 | 55.0 | 4 weeks 2 days | 69.8 | 5 weeks 3 days |

| Petrol | 262.7 | 46.0 | 5 weeks 3 days | 49.0 | 6 weeks 4 days |

| LPG* | 14.9 | 6.5 | 2 week 2 days | 4.0 | 3 weeks |

| ATK | 16.2 | 5.5 | 3 weeks | 0 | 5 weeks |

| Kero** | 1.6 | 0.15 | 11 weeks | 0 | 11 weeks |

| Premix | 1.0 | 2.1 | 2 days | 0 | 2 days |

| RFO | 8.7 | 1.7 | 5 weeks | 0 | 5 weeks |

*LPG figures are in million kilograms *High Kerosene stocks are from previous productions by TOR / Woodfields

Expected Cargoes in Week 46 (13th – 17th November 2023)

A total of about 101.6 million liters of refined petroleum products are expected this week. These comprise 52.1 million liters of Petrol and 49 million liters of Diesel.

Atuabo Gas Processing Plant

The Gas Processing Plant (GPP) at Atuabo is currently producing LPG at an average rate of about 311.90MT/day.

Tema Oil Refinery

The RFCC unit at TOR remains shut down due to reconstruction, while CDU is also shut down due to a lack of Crude Oil.

Liquified Petroleum Gas (LPG) Imports

LPG/C Sapet Gas is at anchorage with 4,000 mt of LPG on behalf of PWSL and Alfapetro.

Fuel Oil Import

There is currently adequate local production to meet domestic demand.

Aviation Turbine Kerosene (ATK) Imports

MT Sea Panther is at anchorage with 10kt of ATK on behalf of Fueltrade.

Expected Cargoes in Week 46 (13th to 17th November 2023)

| NO. | BIDEC | Volume Diesel (Lts) | Volume Petrol (Lts) | Vessel Name | Status |

| 1 | Maranatha | 49,006,500 | Doric Breeze | Anchorage | |

| Stratecon | 42,603,480 | Hafnia

Andromeda |

Anchorage | ||

| BP Ghana | 9,467,440 | Discharging | |||

| Total | 52,070,920 | 49,006,500 | |||

Source: National Petroleum Authority