Crude Oil and Refined Products Market Review and Outlook

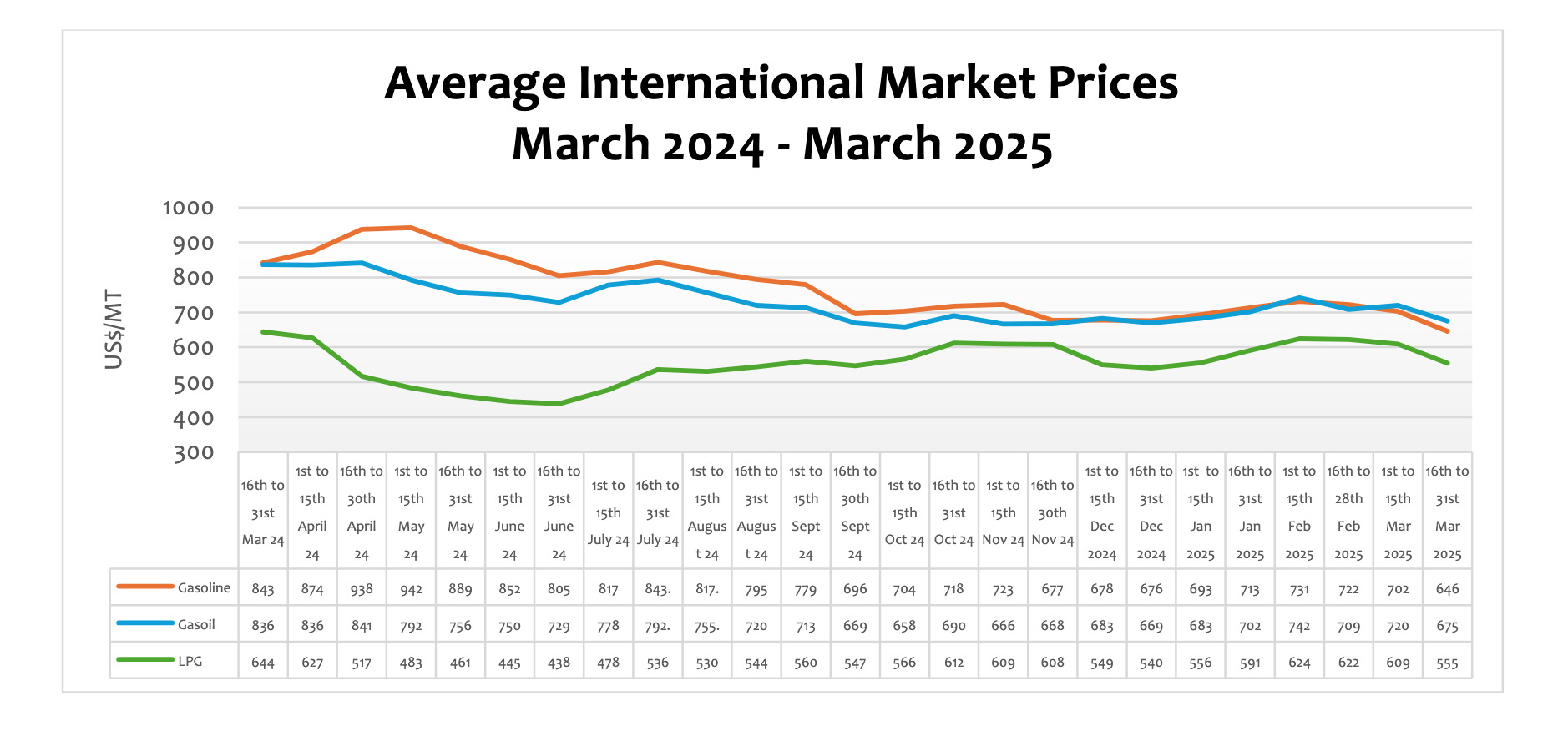

Global crude prices peaked on 17th February with Brent spot prices rising to $83/bbl. According to CITAC Africa, this was largely due to “the trade-war instigating rhetoric and actions of the new Trump Administration in the US”. The price of crude rose in February due to the sharp decline in global stock, especially in the US. This largely attributed to the rise in price in the first selling window of March 2025. The U.S. Energy Information Administration (EIA) also attributed the rise in crude prices in February to the US Administration’s tariff war policies, which affected the supply chain dynamics within the oil markets, contributing to market volatility. Moreover, available data shows that OECD industry inventories of crude and refined products fell to their lowest levels for this time of the year since 2022.

Notwithstanding, global demand and rising inflationary pressures continue to push down international prices. CITAC reports that despite a significant tightening in global inventories, prices continue to decline due to concerns over global demand, notably in China.

As a results of the US Treasury imposition of new sanctions on various entities and vessels involved in shipping Iranian crude oil to China and the announcement of the 25% tariffs on all imports from Canada and Mexico, as well as a 10% tariff on imports from China in addition to other global economic factors, crude, petrol, diesel, and LPG declined significantly by 4.14%, 9.00%, 6.33%, and 8.98% respectively.

The Dangote Oil Refinery Company (DORC) achieved high throughput over the first half of January, with the plant hitting record crude processing rates of 450 kb/d. The refinery is expected to ramp up to 450 kb/d going forward assuming no major outages or disruptions to crude supply, this will potentially impact gasoline imports from Europe.

FuFeX30 and Spot Rates

The Fufex30[1] for the Second selling window of March (16th to 31st March 2025) is estimated at GHS15.8000/USD, while the applicable spot rate for cash sales is GHS15.6000/USD based on quotations received from oil financing commercial banks.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 1st to 15th November 2024 | 26% | 16.3933 |

| 16th to 30th November 2024 | 28% | 16.2094 |

| 1st to 15th December 2024 | 27% | 15.5388 |

| 16th to 31st December 2024 | 26% | 14.8133 |

| 1st to 15th January 2025 | 25% | 14.7690 |

| 16th to 31st January 2025 | 26% | 14.9443 |

| 1st to 15th February 2025 | 20% | 15.4725 |

| 16th to 28th February 2025 | 23% | 15.4684 |

| 1st to 15th March 2025 | 24% | 15.5582 |

| 16th to 31st March 2025 | 23% | 15.5543 |

The BoG’s biweekly FX auction to BIDECs in the 16th to 31st March 2025 pricing window for the purchase of petroleum products was US$20 million, representing 23% of BIDECs’ bid. The FX rate at which the BoG auctioned to BIDECs rose from GHS14.7690 in January 2025 to GHS15.5543 per USD in the current window, representing an appreciation of 0.o2%. It is expected that the government’s fiscal policy measures as outline in the 2025 Budget if implemented will stabilize the cedi and pump prices.

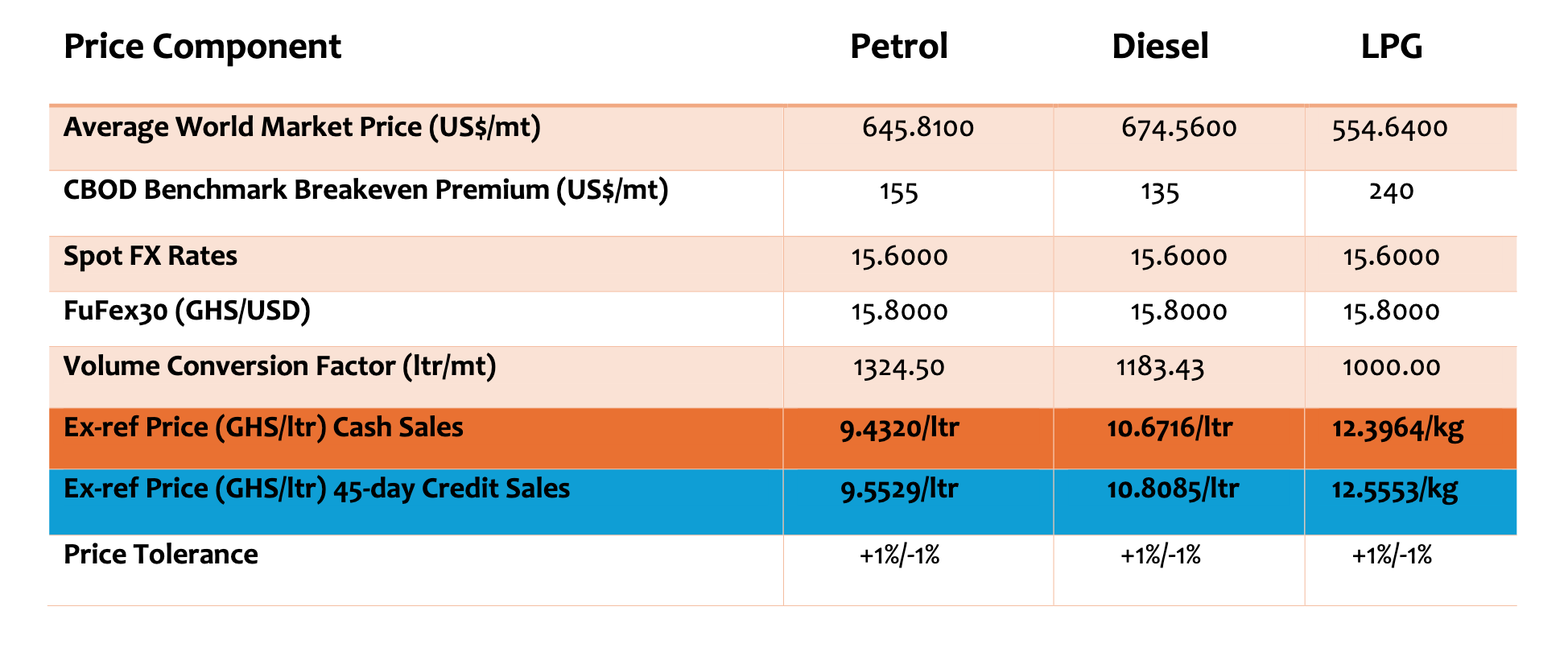

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window, and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 16th to 31st March 2024

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th March 2024 selling window accounted for 21.48%, 21.05%, and 12.25% of the ex-pump prices of petrol, diesel, and LPG, respectively.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) LPG (GHS/KG) | |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 3.27 | 3.25 | 2.11 |

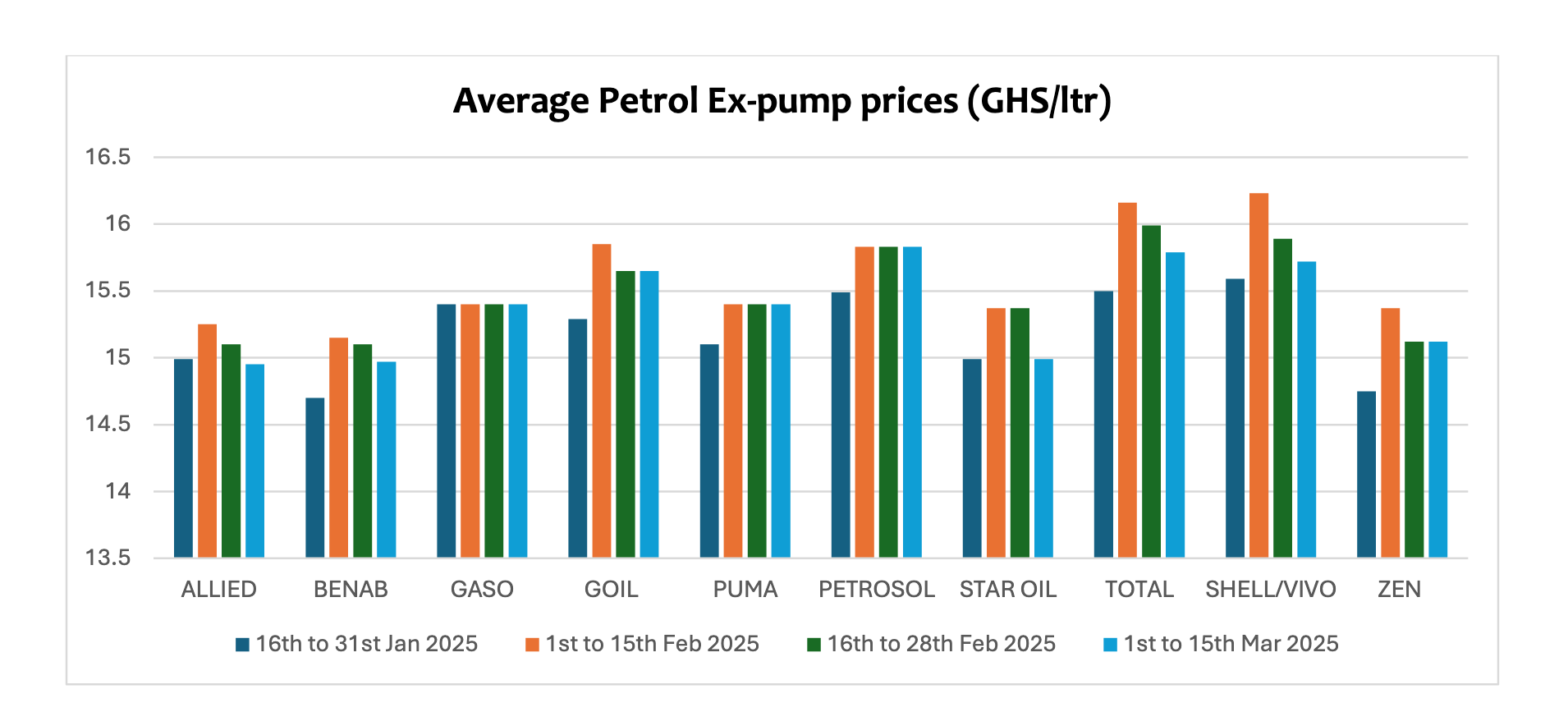

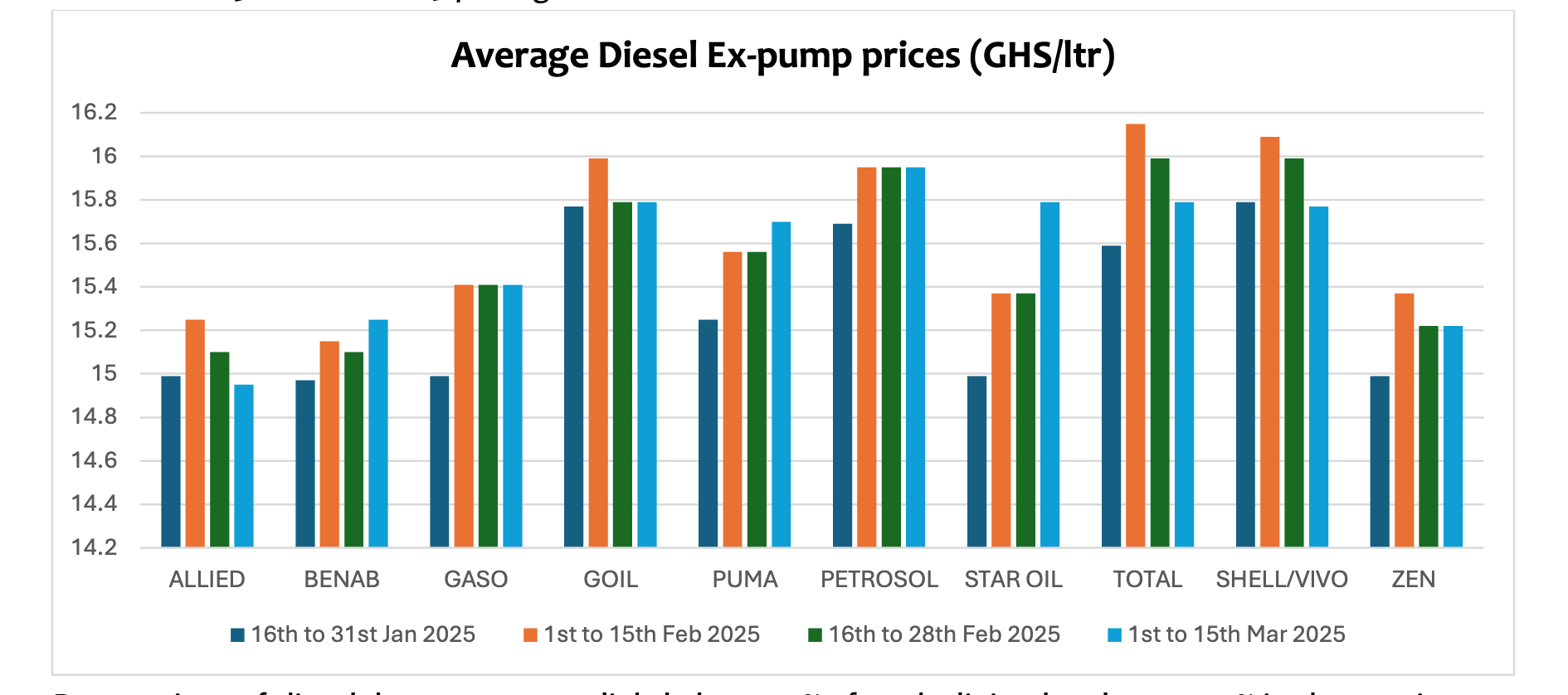

OMC Pricing Performance: 1st to 15th March 2025

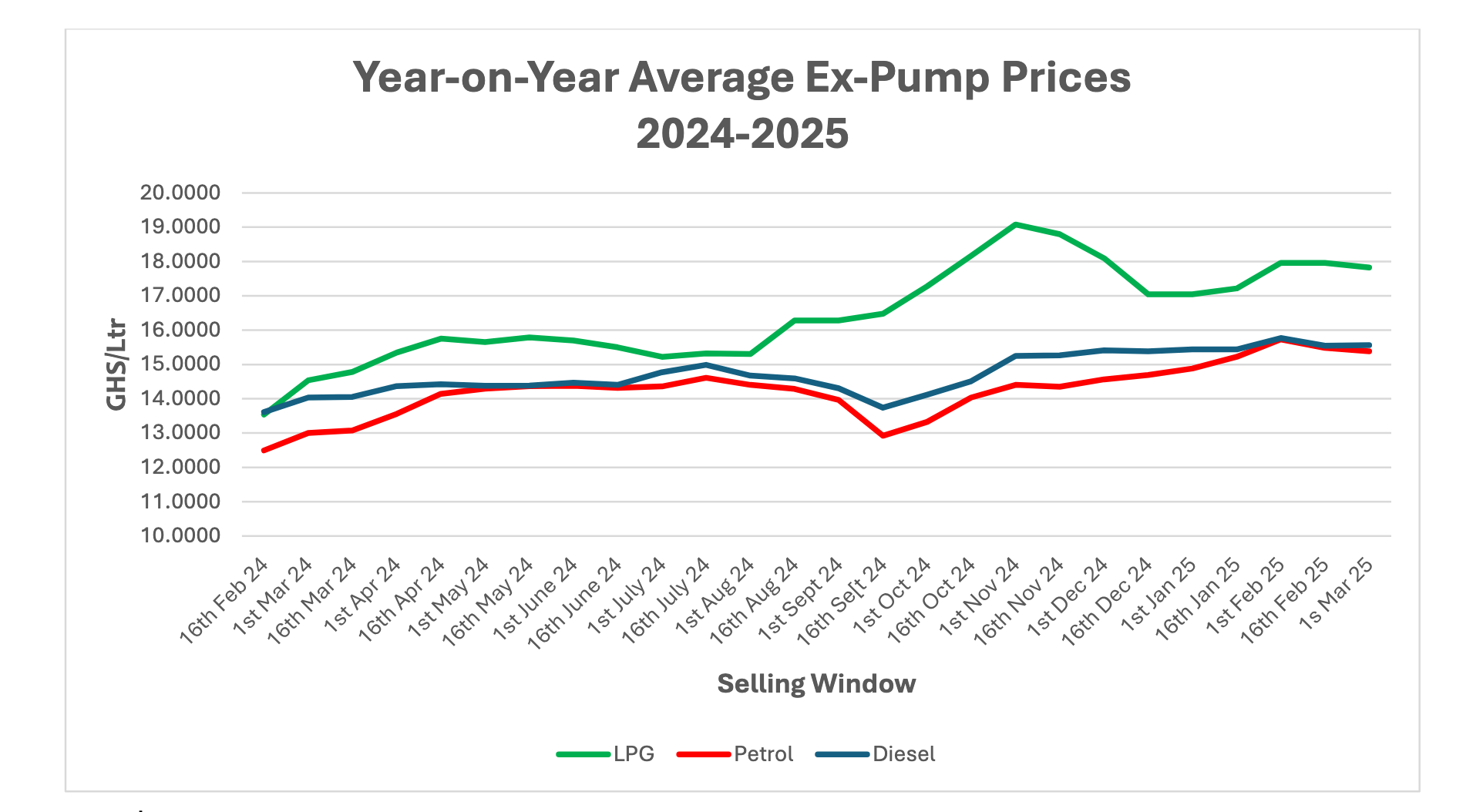

Pump price of petroleum products has been relatively stable since the second window of January. This has been largely attributed to the relative stability of the cedi over the period. International price of petroleum products has also fallen significantly, partly contributing to the relative stability in the price of petroleum products at the pumps.

The pump prices of petroleum products in Ghana are largely driven by international prices and Cedi/USD exchange rates. According to the Minister of Finance in the reading of the 2025 Budget statement to

Parliament, the cedi depreciated by 19.2% against the USD in 2024. This resulted in the high pump prices (10% increase in the average pump price of petrol and diesel), contributing to the national inflation of 23.8 in 2024. Government has however, indicated its commitment to continue the special FX auction to BIDECs and to improve exchange rate stability, reduce imported inflation and fuel prices.

Government has also indicated his commitment to stabilize the macroeconomy and the cedi through urgent economic recovery programs to shore up foreign reserves to about 3 months of import cover and to build sufficient buffers in the Sinking Fund to manage public debt servicing. These interventions will continue to firm up the cedi against its major trading currencies in 2025.

In the pricing window under review, pump prices of petrol fell by 0.67% compared to 0.71% in the previous window. Pump prices of petrol are currently around 18.3% higher on a year-on-year basis. Given the current decline in global prices and the relative stability of the cedi, petrol prices are expected to decline slightly in the 16th to 31st March 2025 pricing window.

Pump prices of diesel, however, rose slightly by 0.09% after declining by about 0.52% in the previous window. Pump prices of diesel are about 10.9% higher on a year-on-year basis. Pump price of diesel is expected to decline slightly in the 16th to 31st March 2025 pricing window.

As global demand is expected to remain stable due to weak market sentiments, pump prices are projected to range above GHS13/Ltr. However, this projection is highly dependent on the performance of the cedi.