Crude Oil and Refined Products Market Review and Outlook

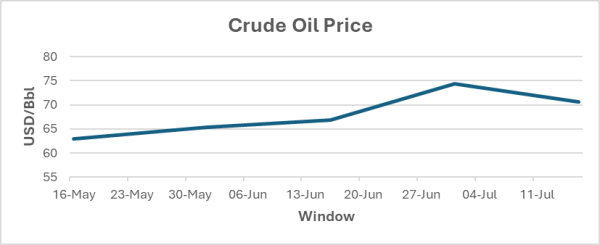

The international market price of crude and petroleum products has resumed trending downwards after the ephemeral spike during the Israel–Iran conflict. Although global crude prices have been on a downward trajectory since the third Quarter (Q3) of 2024 due to the uncertainties in the global economy introduced by the US–China tariff war, the Israel–Iran conflict in June led to a sudden spike, which lasted till the ceasefire was agreed upon. Crude oil prices rose suddenly by about 12% when the conflict began (See figure below).

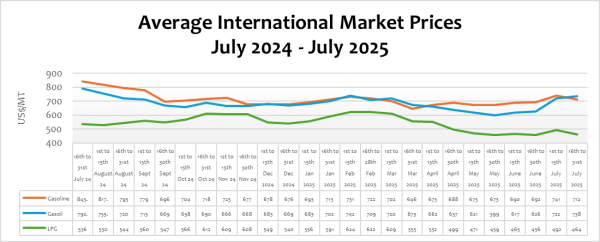

Moreover, refined petroleum products including petrol, diesel, LPG, and kerosene rose sharply when the conflict began. Petrol, Diesel, LPG, Kerosene rose by 7.08%, 15.45%, 7.78%, and 13.71%, respectively due to the conflict and the expectation that the Strait of Hormuz was going to be closed. Following the ceasefire agreement between the two countries, crude and petroleum products have began to decline.

Additionally, Reuters news reports that the OPEC+ nations agreed at a meeting in the first week of July to raise production by 548,000 barrels per day (bpd) in August, up from the 411,000 bpd the group had approved for May, June and July and 138,000 bpd for April. This production boost is expected to come from Saudi Arabia, Russia, the United Arab Emirates, Kuwait, Oman, Iraq, Kazakhstan and Algeria.

It is expected that as the OPEC+ nations increase their production as indicated, crude and petroleum prices at the global market will decline to their levels before the war began.

FuFeX30 and Spot Rates

The Fufex30[1] for the second selling window of July (16th to 31st July) is estimated at GHS11.0000/USD, while the applicable spot rate for cash sales is GHS10.5000/USD based on quotations received from oil financing commercial banks.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 1st to 15th May 2025 | 22% | 14.2877 |

| 16th to 31st May 2025 | 22% | 12.5027 |

| 1st to 15th June 2025 | 36% | 10.3371 |

| 16th to 30th June 2025 | 22% | 10.3284 |

| 1st to 15th July 2025 | 23% | 10.4033 |

The BoG’s biweekly FX auction to BIDECs in the 1st to 15th July 2025 pricing window for the purchase of petroleum products was US$20 million, representing just 23% of BIDECs’ bid. Due to the recent appreciation of the cedi against the US dollar, the BOG interbank is currently selling at GHS10.40/USD. The central bank is currently considering a more comprehensive approach to review the current biweekly auction to BIDECs to a new regime where BIDECs will participate in the auction through their commercial banks. This is expected to be piloted by the end of July 2025.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 16th to 31st July 2025

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 711.95000 | 737.500 | 464.0500 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 200 | 200 | 255 |

| Spot FX Rates | 10.5000 | 10.5000 | 10.5000 |

| FuFex30 (GHS/USD) | 11.0000 | 11.0000 | 11.0000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 7.2295/ltr | 8.3180/ltr | 7.5500/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 7.5738/ltr | 8.7141/ltr | 7.9096/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th July 2025 selling window accounted for 28.36%, 24.92%, and 15.23% of the ex-pump prices of petrol, diesel, and LPG, respectively.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY SECTOR SHORTFALL AND DEBT REPAYMENT LEVY | 0.95 | 0.93 | 0.73 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 3.27 | 3.25 | 2.11 |

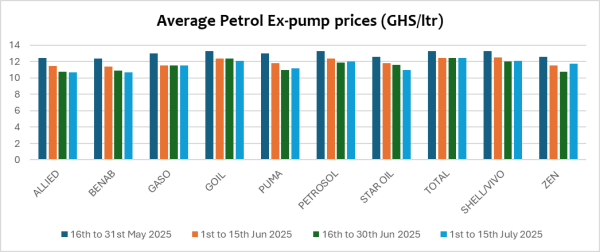

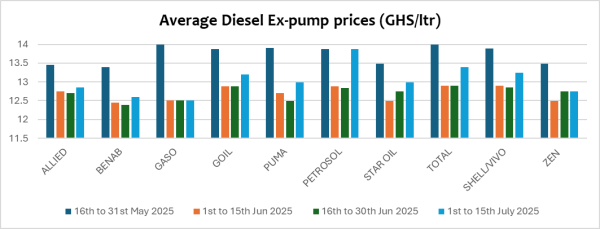

OMC Pricing Performance: 1st to 15th July 2025

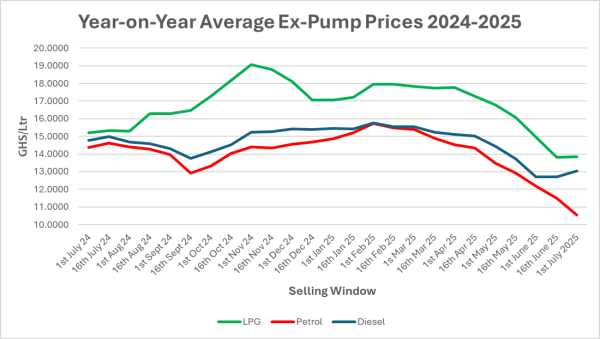

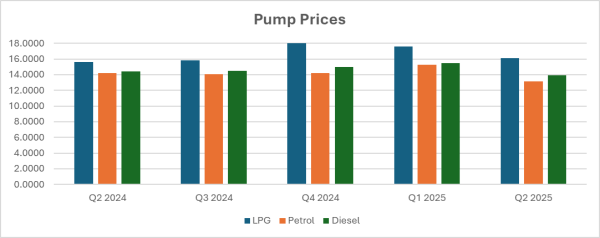

Generally, pump prices of petroleum products (petrol, diesel, and LPG) have been witnessing significant declines since the beginning of the year. This downward trajectory has been attributed by the Oil Marketing Companies (OMCs) to the appreciation of the Cedi and the decline in global prices of petroleum and crude oil. The Bulk Import Distribution and Exports Companies (BIDECs), who are the importers of petroleum products in the country, have attributed the declining pump prices to government efforts in maintaining the stability of the cedi in recent times. Although the continuous decline of crude and petroleum product prices at the international market partly accounts for the plummeting pump prices, the appreciation of the cedi is the main reason for the declining pump prices.

For the first time since October 2022, pump prices have fallen below GHS11/Ltr. Pump prices escalated significantly in November 2022 when the Cedi/USD exchange rate rose from about GHS9 to about GHS15 per USD. As a result of the depreciation of the cedi, pump prices of petrol and diesel rose to about GHS18/Ltr and GHS23/Ltr, respectively in November 2022. Pump prices have been on the high side since then, selling above GHS14/Ltr. However, the recent appreciation of the cedi has led to a significant decline in pump prices, as seen in the figure below.

The Ghana cedi, which was trading at about GHS14.85/USD at the end of December 2024, has appreciated significantly, currently trading at about GHS10.30/USD by the commercial banks as of 14th July 2025 (about 30% appreciation). The strong appreciation of the cedi has been largely attributed to a mix of fiscal tightening, improved gold reserves, sound economic policies and global factors, including the US–China tariff war.

Moreover, crude oil prices on the global market declined by about 10% in Q2 compared to Q1 and about 16% compared to the same period last year – leading to declining pump prices. The decline in global prices has been attributed to increased global production and weak global economic growth.

Due to the performance of these factors, which are the main determinants of pump prices, petrol, diesel and LPG pump prices have declined significantly since January by 29.21%, 15.53% and 18.72%, respectively. The figure above shows the sharp decline in pump prices from Q4 2024 to Q2 2025. However, the recent Israel–Iran conflict has resulted in a significant rise in the international price of crude and other petroleum products. This led to the slight increase in the pump prices of petrol, diesel, and LPG in the pricing window under review.

In the window under review, petrol rose slightly by 0.18% due to the Israel–Iran conflict and the threat to close the Strait of Hormuz that led to the significant rise in global crude and petroleum products prices. Average prices of Petrol at the pumps are down by 26.70% year to date and down by 20.00% compared to Q2 2025.

The average pump prices of diesel and LPG rose by 2.65% and 0.22%, respectively, compared to a decline in the last window of about 0.09% and 7.54% respectively. On a year-on-year basis, both products are down by 11.74% and 8.95%, respectively.

As the Israel-Iran conflict is currently under ceasefire, global prices of crude and petroleum products have begun to decline. The spike in international prices in June due to the retaliatory attacks between Israel and Iran is currently reversing due to the truce currently underway. While it is expected that pump prices will decline due to the fall in international prices, the government’s implementation of the GHS1/Ltr levy on petroleum petrol and diesel will increase pump prices. The Ghana Revenue Authority (GRA) has directed OMCs to implement the Energy Sector Shortfall and Debt Repayment Levy (GHS1) on a litre of petrol and diesel starting the pricing window of 16th July 2025.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.