Crude Oil and Refined Products Market Review and Outlook

Global crude oil prices on the global market have been relatively stable in the last quarter of 2024, reflecting a balanced supply-demand dynamic in the international market. This is largely attributed to the political transition in the US, which introduces uncertainties surrounding the US foreign policy direction . This notwithstanding, crude oil prices declined by an average of about 2% mainly as a result of weak macroeconomic fundamentals, lackluster demand, and increasing crude oil production. According to CITAC Africa, global crude prices are currently hitting an upward trend due to complex and potentially volatile geopolitical environment, especially after the latest developments in Syria and the expectations of tighter sanctions on Iran under the incoming Trump’s administration.

The US Energy Information Administration (EIA) expects US crude oil production to increase steadily over the course of 2025 and to average 13.52mn b/d in 2025. This will potentially increase global supply to about 104.8mn b/d in 2025, driven majorly by supply from the non-OPEC+ nations.

Crude oil prices are projected by Reuters to remain capped at approximately $70 per barrel in 2025, driven by persistently weak demand from China and anticipated increase in global supply. Additionally, the growth in global oil demand is expected to face further pressure from the accelerating transition to renewable energy and the rising adoption of electric vehicles.

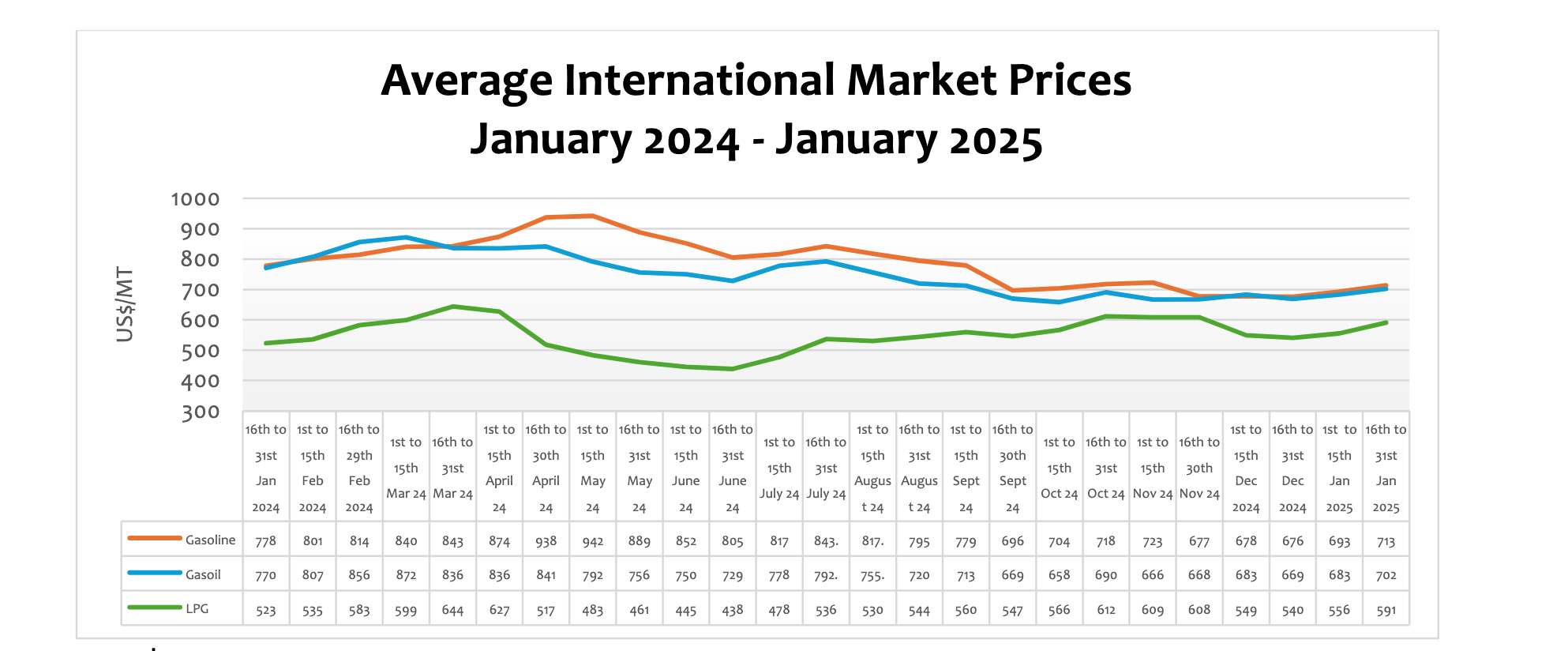

Global market prices of Crude, petrol, diesel, and LPG rose by 3.92%, 2.93%, 2.77%, and 6.32%, respectively, due to the imposition of new sanctions on Russian oil producers and tankers by the US. According to Reuters, the U.S. has imposed sanctions on Russian oil producers Gazprom Neft and Surgutneftegaz, as well as on 183 vessels that that is being used by Russia to skirt sanctions to get its oil to global markets.

FuFeX30 and Spot Rates

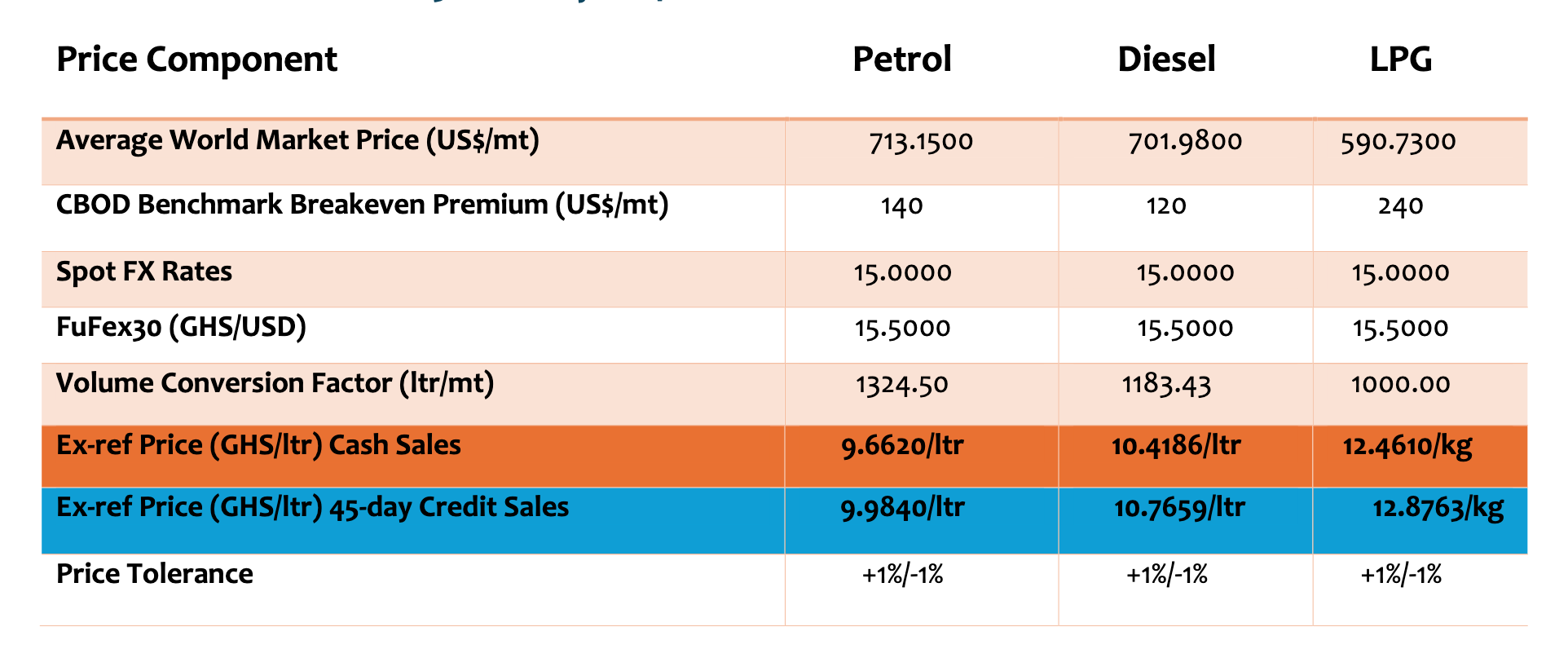

The Fufex30 [1] for the second selling window of January (16th to 31st January ) is estimated at GHS15.5000/USD, while the applicable spot rate for cash sales is GHS15.0000/USD based on quotations received from oil financing commercial banks.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 16th to 31st October 2024 | 40% | 15.8682 |

| 16th to 30th September 2024 | 31% | 15.6631 |

| 1st to 15th October 2024 | 32% | 15.7994 |

| 16th to 31st October 2024 | 40% | 15.8682 |

| 1st to 15th November 2024 | 26% | 16.3933 |

| 16th to 30th November 2024 | 28% | 16.2094 |

| 1st to 15th December 2024 | 27% | 15.5388 |

| 16th to 31st December 2024 | 26% | 14.8133 |

| 1st to 15th January 2025 | 25% | 14.7690

|

The BoG’s biweekly FX auction to BIDECs in the 1st to 15th January 2025 pricing window for the purchase of petroleum products was US$20 million, representing 26% of BIDECs’ bid. The FX rate at which the BoG auctioned to BIDECs rose from GHS10.5151 in January 2024 to GHS16.2094 per USD in November, representing a depreciation of 54.15%. The BOG auction ended the year 2024 at a rate of about GHS14.8133 to the USD. This implies that from January to December 2024 the cedi depreciated by about 40.88% to the USD.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window, and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 16th to 31st January 2024

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th January 2024 selling window accounted for 25.31%, 23.72%, and 12.80% of the ex-pump prices of petrol, diesel, and LPG, respectively.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 3.27 | 3.25 | 2.11 |

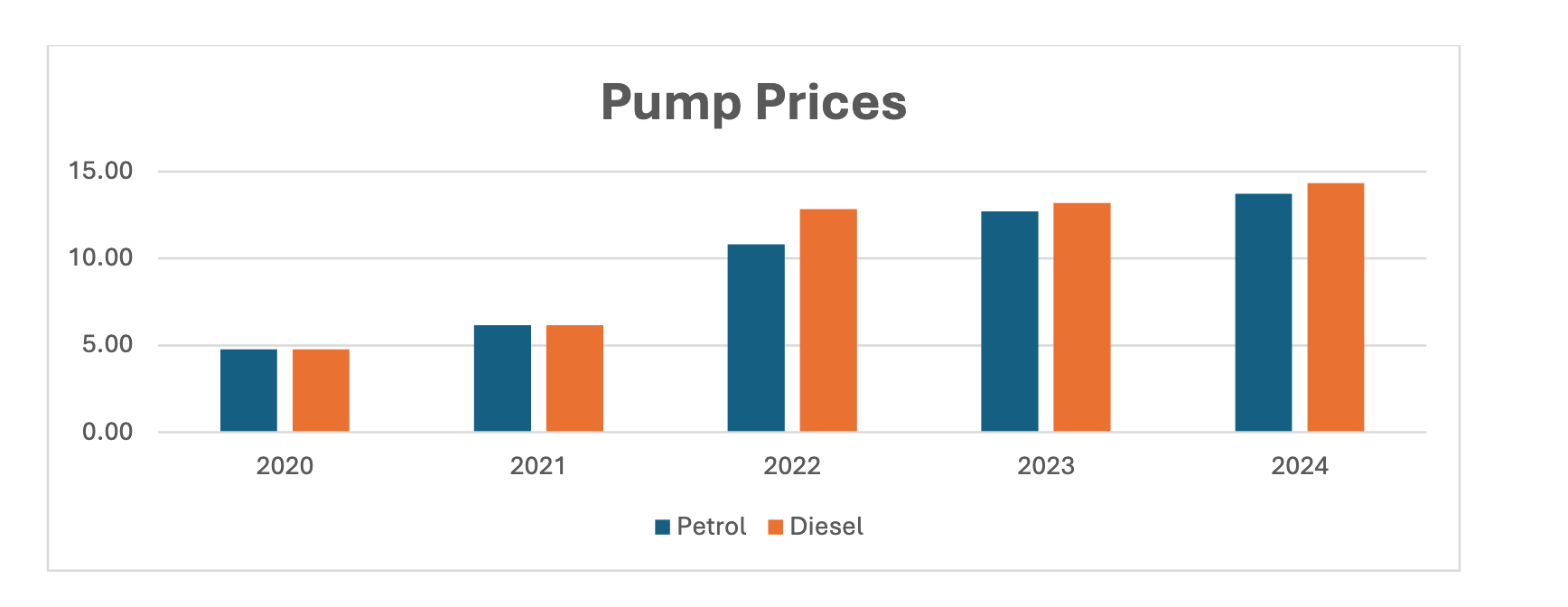

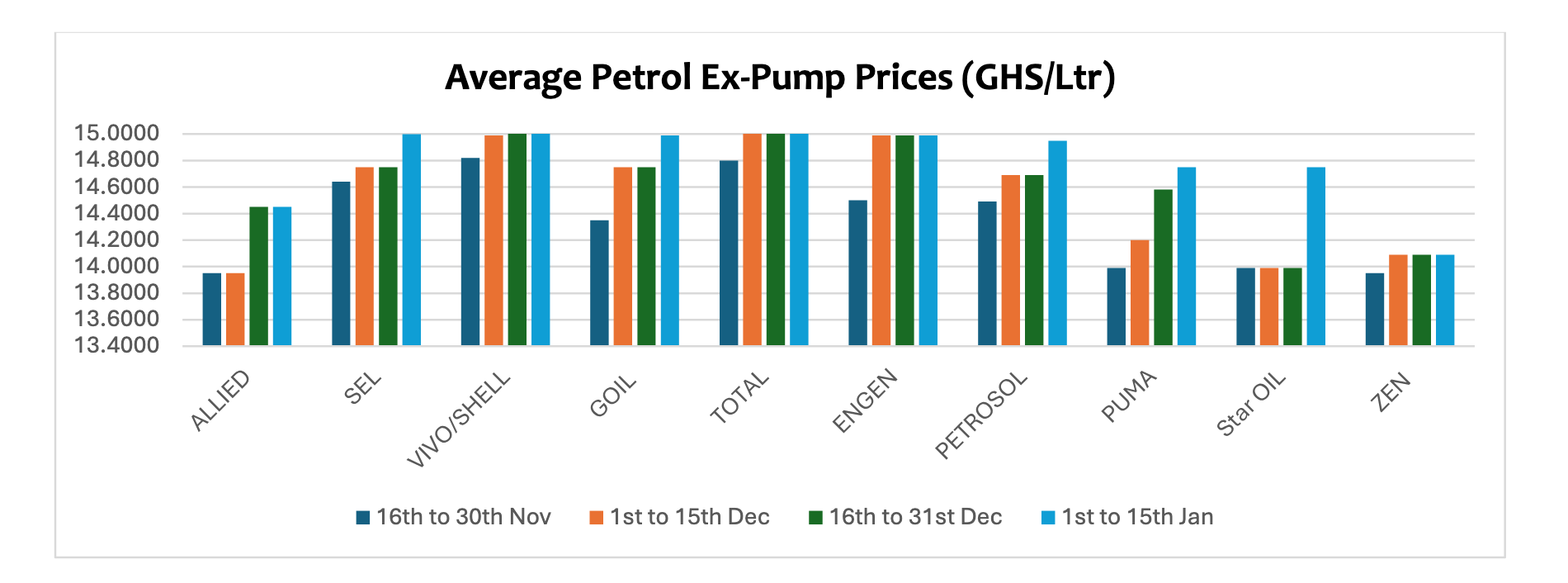

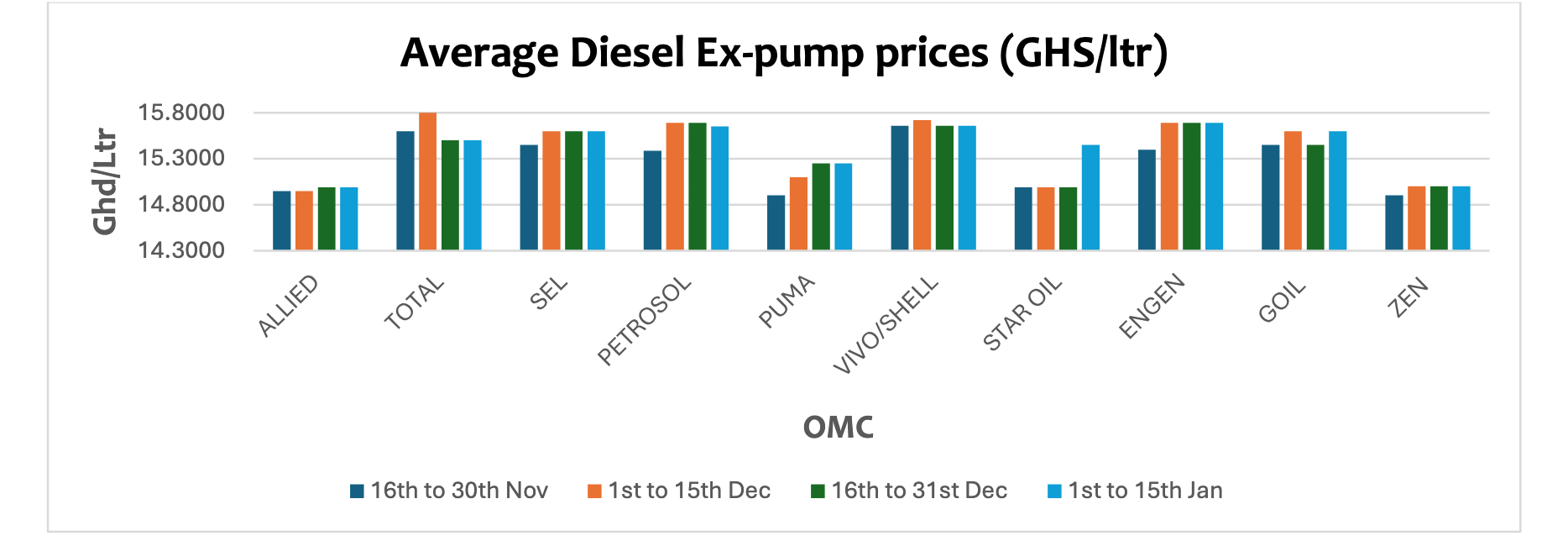

OMC Pricing Performance: 1st to 15th January 2025

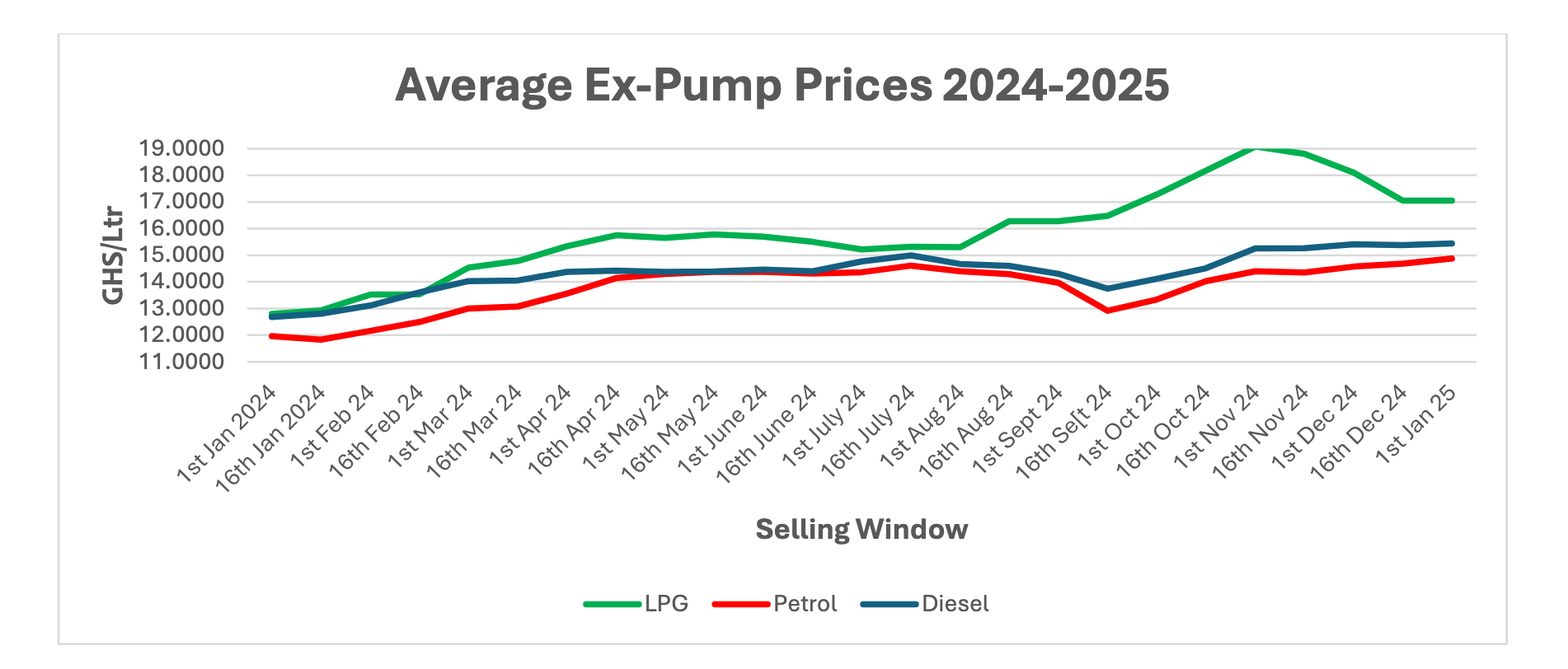

Petroleum product prices at the pumps have remained relatively stable in the last two months of the last quarter of 2024. The relative stability is attributed to the slight appreciation of the cedi against the USD within the period. Pump prices of petroleum products rose significantly in 2024 due to the sharp depreciation of the cedi against its major trading currency. The cedi depreciated by about 40.88% from January to December 2024. This resulted in an about 10% increase in the average pump price of petrol and diesel compared to 2023.

While petrol and diesel prices at the pumps have been above GHS12/Ltr, LPG surged above GHS15/kg despite the introduction of the tender system for the importation of LPG in January 2024. The rising pump prices continue to impact transport fares and cost of transportation and the adoption of LPG.

The GHS/USD exchange which was at about GHS12.10 per USD rose to above GHS16.60 per USD in October before declining to about GHS15.00 per USD in December 2024. The decline in the FX rate was due to the BoG’s intervention in providing FX to BIDECs for the importation of petroleum products ahead of the festive season.

Pump prices of petrol have increased by over 19.40% on a year-on-year basis. Given the relative stability of the cedi, petrol prices are expected to remain stable in 2025 contingent on the stability of global geopolitical and economic circumstances.

Pump prices of diesel also rose slightly by about 0.41% in the window under review and about 21.71% since January 2024. Presently, diesel is being sold at an average rate of GHS15.4390/Ltr, compared to GHS12.7450/Ltr and GHS10.2740/Ltr in 2023 and 2022, respectively.

Global demand is expected to remain stable in the first quarter of the year, which will potentially reduce pump prices if the cedi continues to appreciate against the USD. However, the recent sanctions on Russian crude exports and Iran are expected to impact global prices. Pump prices are expected to rise slightly in the 16th to 31st January window due to the rising international prices of petroleum products importation.