Crude and Refined Products Price Review and Outlook

International crude oil prices increased by about 5.19% in the 27th January to 11th February 2026 pricing window, with benchmark prices surpassing USD70/bbl for the first time in seven months. The increase was largely driven by escalating tensions between the Trump’s administration and Iran, following protests in several Iranian cities over economic challenges and subsequent U.S. allegations of human rights violations against protesters.

Additionally, sanctions by the US and EU on Russian oil exports contributed to shifting trade flows and supply constraints. Iran, which has been a key buyer of Russian crude since 2022, reportedly reduced its Russian imports considerably. Reuters News reported that India’s imports of Russian crude dropped by about 22% in December 2025, marking their lowest level since the Russian – Ukraine war began.

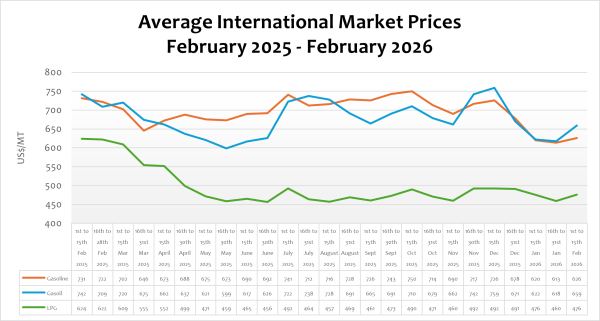

Consequently, refined petroleum prices, petrol, diesel, LPG, and kerosene, edged up significantly by an average of 4.17%, 5.57%, 6.81% and 4.64%, respectively. The recent surge in international prices is considered unusual considering the increasing supply of crude oil and the International Energy Agency’s (IEA) recent forecast that global oil demand will rise more slowly this year than was previously expected. The Agency projects that global supply will outpace demand by about 4% in 2026 due to the increasing production by both OPEC and Non-OPEC nations.

Due to the recent rise in international prices, we expect that pump prices in Ghana in the coming window of 16th to 28th February to rise proportionately. Consumers should therefore anticipate a moderate rise in petrol, diesel, and LPG prices at the pumps from 16th February.

FuFeX30 and Spot Rates

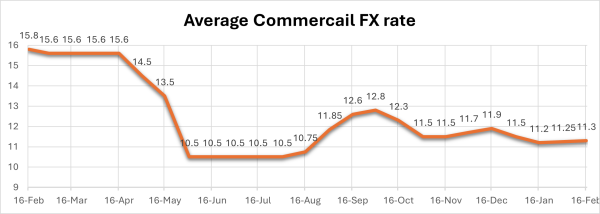

The Fufex30[1] for the first selling window of February (16th to 28th February 2026) is estimated at GHS11.3000/USD, based on quotations received from oil financing commercial banks. Moreover, the applicable spot rate for cash sales is estimated at GHS11.1000/USD based on quotations from oil financing commercial banks, representing a depreciation of 1%.

The cedi began the year 2025 at about GHS15.00/USD, before rising to about GHS15.80/USD. It, however, declined sharply in the second quarter of the year to GHS10.50/USD. The local currency, although volatile throughout 2025, remained quite stable throughout the second half of the year. This brought predictability in business planning, resulting in the sustained decline in pump prices from an average of about GHS15.00/Ltr in January 2025 to an average of about GHS10.50 in January 2026.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window, and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 16th to 28th February 2026

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 652.4600 | 695.9400 | 508.7700 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 200 | 200 | 250 |

| Spot FX Rates | 11.1000 | 11.1000 | 11.1000 |

| FuFex30 (GHS/USD) | 11.3000 | 11.3000 | 11.3000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 7.1441/ltr | 8.4035/ltr | 8.4778/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 7.2728/ltr | 8.5549/ltr | 8.6306/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th February 2026 selling window accounted for about 39.45%, 35.27%, and 16.52% of the ex-pump prices of petrol, diesel, and LPG, respectively. This shows that consumers are overburdened with levies on petroleum products.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY SECTOR SHORTFALL AND DEBT REPAYMENT LEVY | 1.95 | 1.93 | 0.73 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 4.27 | 4.25 | 2.11 |

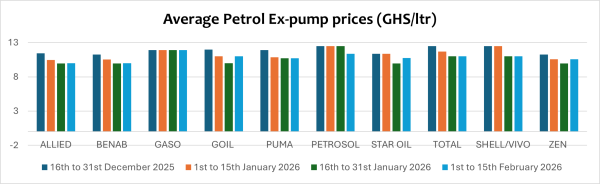

OMC Pricing Performance: 1st to 15th February 2026

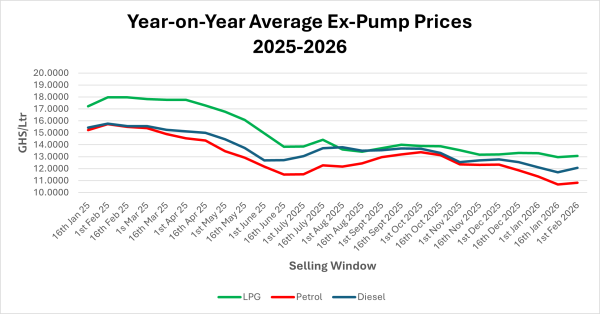

Over the past nine consecutive months, petroleum consumers in Ghana have experienced a sustained decline in pump prices, providing significant relief in transportation costs and easing inflationary pressures. Consequently, the average pump prices of petroleum products recorded a marked reduction in 2025 relative to 2024. Notwithstanding this downward trend, pump prices in 2025 remained elevated when compared to levels observed in 2021 and 2022. Prices surged considerably in 2023 and 2024, largely driven by the sharp depreciation of the cedi against major trading currencies and the spike in international crude oil prices following the Russia–Ukraine conflict. Between January and December 2024, the cedi depreciated by approximately 40.88%, contributing to an estimated 10% increase in the average pump price despite the about 10% decline in international prices within the period.

The marked appreciation of the cedi against major trading currencies since April 2025 has been the primary driver of the recent decline in pump prices. In addition, international petroleum prices have eased considerably in recent months, largely due to expectations of increased output from both OPEC and non-OPEC producers, including the United States, Canada, Brazil, and Guyana. Notably, pump prices fell to their lowest level in the second pricing window of January 2026, the lowest recorded since May 2022.

The cedi was ranked as the best-performing currency in Africa in 2025, underscoring the improved macroeconomic stability achieved during the period and reinforcing investor confidence in both the currency and the broader economy. This sustained stability is expected to continue influencing petroleum product prices at the pump.

In the window under review, pump prices of petrol rose slightly by about 1.30%, although some OMCs are selling below GHS10/Ltr. On a year-on-year basis, pump prices of petrol are down by about 31.20%. Given the slight depreciation of the cedi and the rise in the international prices, petrol prices are expected to rise slightly in the second window of February.

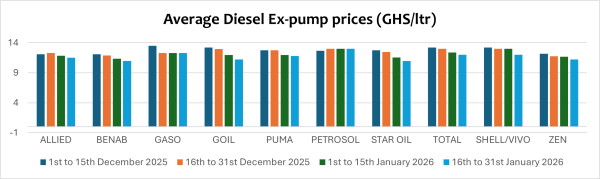

Pump prices of diesel also rose by an average of about 3.17% in 2025. Compared to the same period last year, pump prices of diesel are down by 23.50%. Diesel is currently being sold below GHS12/Ltr among some OMCs.

Following the recent rebound in international crude and refined product prices, alongside the slight weakening of the cedi, pump prices are projected to experience a marginal increase in the 16th to 28th February 2026 pricing window.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.