Crude Oil and Refined Products Market Review and Outlook

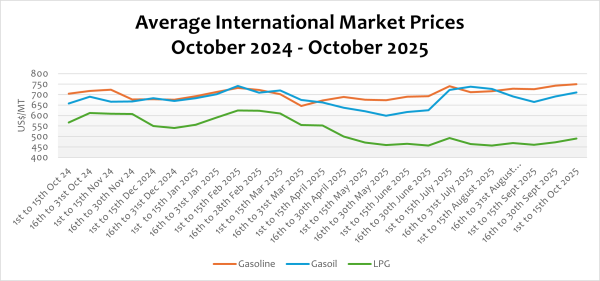

Compared to August 2025, global petroleum markets in September recorded modest price uptick across crude oil and refined products, reflecting the combined impact of geopolitical tensions and broader economic conditions. In the pricing window under review, crude oil prices rose by about 1.86%, driven largely by supply constraints linked to the sanctions imposed on Russia and Iran’s oil exports. These restrictions have limited global supply flows, leading to market imbalances.

Refined petroleum products (petrol, diesel, and LPG) also rose by 0.96%, 2.81%, and 3.58% respectively, within the pricing window under review. The relatively higher increase in the prices of these products reflects both their critical role in industrial and household consumption, as well as heightened competition for supply in international markets. On a year-on-year basis, petrol and diesel prices rose by about 6.52% and 7.87% respectively, while LPG declined by 13.55%. Moreover, from January to date, petrol and diesel prices have increased by 8.24% and 3.96% respectively, reflecting persistent demand pressures and structural tightness in global product markets..

In addition to geopolitical factors, broader macroeconomic circumstances, including inflationary trends, currency volatilities, and uneven economic growth prospects, continue to impact price volatility.

It is expected that despite the tough sanctions on Russian and Iranian oil, the increasing production by both OPEC and non-OPEC countries such as Brazil, Canada, and the US will balance out the supply and demand pressures in the last quarter of the year.

FuFeX30 and Spot Rates

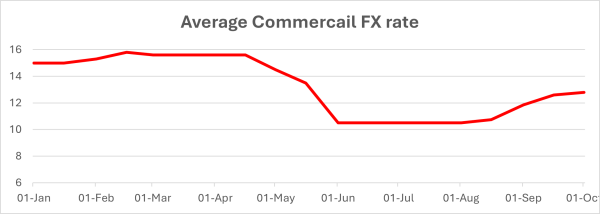

The Fufex30[1] for the first selling window of October (1st to 15th October) is estimated at GHS12.9000/USD, based on quotation from oil financing commercial banks. Moreover, the applicable spot rate for cash sales is estimated at GHS12.5000/USD based on quotations from oil financing commercial banks.

The cedi for the last two months has depreciated significantly from about GHS10.50/USD in August to about GHS12.80/USD at the end of September This sharp depreciation has been a key driver of the upward adjustment in pump prices over the period. It is expected that various policy interventions by the government and BoG will help to address the volatilities of the currency and make it accessible for the importation of petroleum products into the country. This will significantly contribute to lowering refined petroleum products price at the pumps.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 1st to 15th October 2025

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 749.8900 | 710.0500 | 489.6100 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 200 | 200 | 255 |

| Spot FX Rates | 12.5000 | 12.5000 | 12.5000 |

| FuFex30 (GHS/USD) | 12.9000 | 12.9000 | 12.90500 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 8.9646/ltr | 9.6124/ltr | 9.3076/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 9.2515/ltr | 9.9200/ltr | 9.6055/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 16th to 30th September 2025 selling window account for about 32.38%, 31.04%, and 15.41% of the ex-pump prices of petrol, diesel, and LPG, respectively. This shows that consumers are overburdened with levies on petroleum products.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY SECTOR SHORTFALL AND DEBT REPAYMENT LEVY | 1.95 | 1.93 | 0.73 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 4.27 | 4.25 | 2.11 |

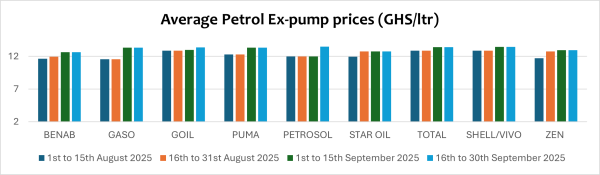

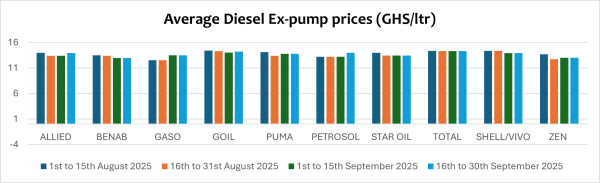

OMC Pricing Performance: 16th to 30th September 2025

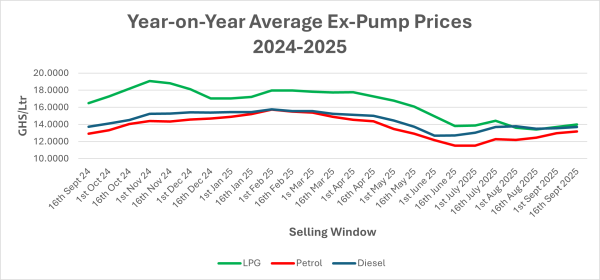

The combined pressures of external market dynamics and domestic currency challenges continue to weigh heavily on fuel pricing and, by extension, broader economic conditions in Ghana. These market dynamics in the downstream petroleum sector have resulted in a notable escalation in pump prices for petroleum products across the country, underscoring the complex interplay between global demand patterns and local currency performance.

Globally, international benchmark prices for petroleum products have risen significantly, influenced by heightened demand associated with the summer season. The increase in consumption across advanced and emerging markets has exerted upward pressure on product prices, with the effects being transmitted into the Ghanaian market, given the country’s reliance on imports for refined petroleum products.

Domestically, the depreciation of the Ghana cedi against the US dollar in recent weeks has compounded these external pressures. As petroleum imports are denominated in foreign currency, the weakening of the local currency has resulted in higher landed costs, thereby feeding directly into retail pump prices. As a result pump price of petrol has increased from about GHS11.5110/Ltr to GHS13.1890/Ltr, while diesel rose from GHS12.6000/Ltr to GHS13.6910/Ltr in just one month. These adjustments represent a substantial increase, with potential implications for inflationary trends, transportation costs, and general economic activity.

This development underscores the importance of stabilising the domestic currency while exploring long-term measures to cushion the economy against external shocks. As a result, stakeholders continue to call on the government to streamline and sanitise the forex market to ensure the availability of forex at competitive rates for petroleum imports. It is expected that the recent directives of the BoG will sanitise the FX market and ensure the stability of the cedi.

Due to the depreciation of the cedi in the period and relatively low stocks of petrol, pump prices of petrol rose by about 1.73% to an average of GHS13.1890/Ltr. Compared to same time last year, pump prices of petrol are up by about 2.80% raising worries about the rising trend of pump prices and its impact on inflation.

Average pump prices of diesel declined by 1.12% from GHS13.4080/Ltr to GHS13.6910/Ltr, while LPG rose above GHS14.000/Kg for the first time in 2 months, due to depreciation of the cedi, government’s decision to exclude LPG from the Energy Sector Shortfall and Debt Repayment Levy (GHS1.00 Levy).

As a result of the rising demand for petroleum products in the summer period and the depreciation of the cedi against the US dollar, pump prices are expected to edge slightly in the coming window of 1st to 15th October 2025.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.