Crude Oil and Refined Products Market Review and Outlook

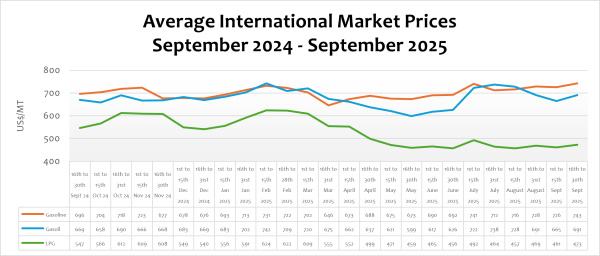

Crude oil prices in the global market have been declining for the fourth consecutive window. Crude oil prices on the global market fell marginally in the window under consideration by 0.52%, demonstrating the sector’s recovery from the geopolitical tensions in Q2 that spiked prices considerably during the period. Similarly, refined petroleum products (petrol, diesel, LPG, and ATK) fell considerably within the same period. In contrast, refined petroleum products Petrol, diesel, LPG, and ATK rose in the window under review by 2.39%, 3.91%, 2.16%, and 1.97% respectively. Crude and petroleum product prices rose sharply in June by about 8% following Israel’s and the US attacks on Iran’s nuclear sites and the resultant retaliatory attacks from Iran. The prices, however, declined when the truce was agreed on by the countries after 12 days of the war. Crude oil prices are down by 8.82% on a year-on-year basis.

Globally, crude oil prices are expected to decline further as the eight (8) OPEC+ nations that voluntarily cut down output by 2.2 million bpd in 2023 to avert soaring prices have now agreed to start a gradual and flexible return of the 2.2 million bpd voluntary adjustments starting in the middle of the year. This increased supply, combined with slower-than-expected global economic growth, US-imposed tariffs, and rising crude output from select non-OPEC producers, is expected to exert additional downward pressure on prices.

Moreover, the growing adoption of electric vehicles (EVs) in recent times continues to diminish the expected growth in the demand for crude and petroleum products. According to the International Energy Agency (IEA), the rapid growth in EV sales over the past 5 years has had a significant impact on the global car fleet, growing to almost 58 million at the end of 2024. This structural shift in transportation energy consumption is expected to weaken demand for crude oil and refined products, contributing to further downward pressure on global prices in the coming months.

FuFeX30 and Spot Rates

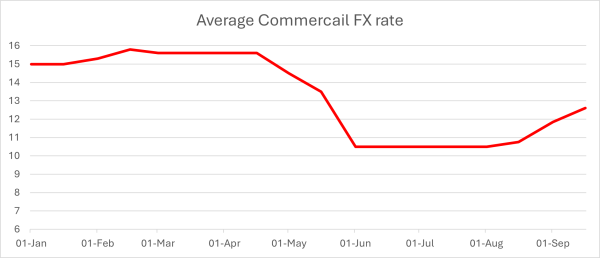

The Fufex30[1] for the first selling window of September (16th to 30th September) is estimated at GHS12.9000/USD, based on quotation from oil financing commercial banks, factoring in the 12% depreciation of the cedi from the last pricing window. Moreover, the applicable spot rate for cash sales is estimated at GHS12.5500/USD based on quotations from oil financing commercial banks.

The cedi from the last selling window has been depreciating sharply, leading to a depreciation from about GHS10.70/USD to about GHS12.50/USD as quoted by some commercial banks.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 16th to 30th September 2025

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 742.7900 | 690.6500 | 472.7100 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 200 | 200 | 255 |

| Spot FX Rates | 12.5500 | 12.5500 | 12.5500 |

| FuFex30 (GHS/USD) | 12.9000 | 12.9000 | 12.9000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 8.9332/ltr | 9.4451/ltr | 9.1328/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 9.1823/ltr | 9.7085/ltr | 9.3875/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th September selling window account for about 34.33%, 31.50%, and 16.09% of the ex-pump prices of petrol, diesel, and LPG, respectively. This shows that consumers are overburdened with levies on petroleum products.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY SECTOR SHORTFALL AND DEBT REPAYMENT LEVY | 1.95 | 1.93 | 0.73 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 4.27 | 4.25 | 2.11 |

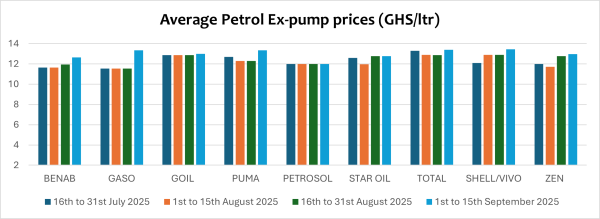

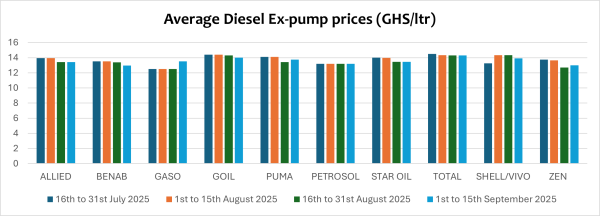

OMC Pricing Performance: 1st to 15th September 2025

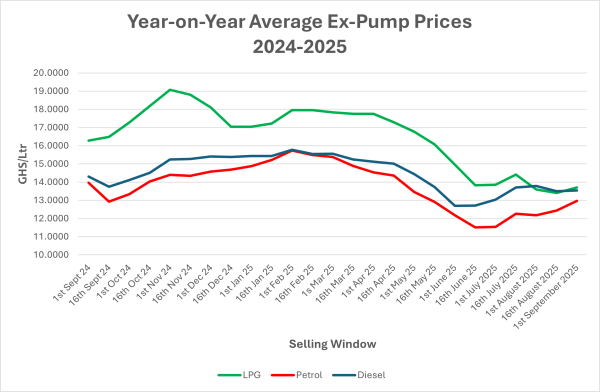

Pump prices of petroleum products have been on a downward trajectory since February, following the significant appreciation and stability of the cedi against the US dollar. However, the recent depreciation of the cedi since the beginning of September has resulted in a significant surge in pump prices. The cedi, which was trading at about GHS14.85/USD at the end of December 2024, appreciated significantly since April to about GHS10.75/USD in the beginning of August 2025, and has, in recent weeks, depreciated to about GHS12.50/USD as of 15th September 2025.

Stakeholders continue to call on the government to streamline and sanitize the forex market to ensure availability of forex at competitive rates for petroleum imports. In view of this, the BOG has issued a directive seeking to enforce the laws governing the foreign currency usage in the country. The directive seeks to strictly enforce the unlawful pricing and invoicing in USD in the country and the operations of the “Black Market”.

It is expected that these measures by the BoG will reduce the unnecessary demand for USD for domestic transactions. When this is effectively enforced, it will promote the stability of the cedi and reduce the constant depreciation of the cedi, and in effect, lower pump prices.

Due to the depreciation of the cedi in the period and low stocks of petrol, pump prices of petrol rose by about 4.25% to an average of GHS12.9650 per liter. On a year-on-year basis, pump prices of petrol are down by an average of 12.85% on a year-to-date basis.

Average pump prices of diesel rose from an average of GHS13.4080/Ltr to an average of GHS13.5400/Ltr due to the depreciation of the cedi. Pump prices of LPG also rose by 2.22% to an average of GHS13.7060/Kg due to the combined effects of the depreciation of the cedi and rise in global prices of LPG.

Pump prices are expected to edge up in the coming window of 16th to 30th September due to the significant depreciation of the cedi and the rise in international market prices of refined petroleum products.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.