Crude Oil and Refined Products Market Review and Outlook

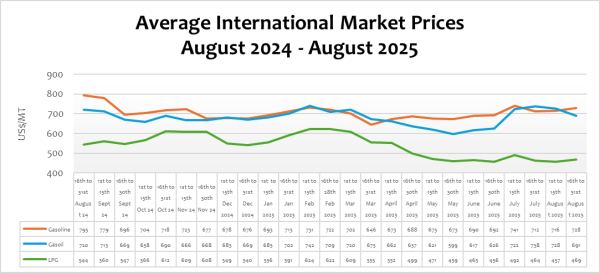

The global market has largely recovered from the geopolitical tensions in June that hiked supply-risk premiums and disrupted the supply chain in June and July 2025. Crude and petroleum product prices rose sharply in June when Israel attacked Iran’s nuclear sites. The attacks led to retaliatory attacks from Iran and the involvement of the US. Crude prices surged significantly as a result, partially truncating the downward trend of petroleum prices since Q4 2024.

Globally, crude oil prices have been on the decline due to slower-than-expected global economic growth, the imposition of tariffs by the US on imports from some of their trade partners, and increasing crude production by both OPEC and non-OPEC nations. Moreover, the growing adoption of Electronic Vehicles (EVs) has significantly impacted crude and petroleum products. According to the International Energy Administration (IEA), the rapid growth in EV sales over the past 5 years has had a significant impact on the global car fleet, growing to almost 58 million at the end of 2024. About 17 million EVs were sold in 2024, rising in China by about 30%. It is expected that as the OPEC+ nations increase their production as indicated, crude and petroleum prices on the global market will decline in the coming months.

FuFeX30 and Spot Rates

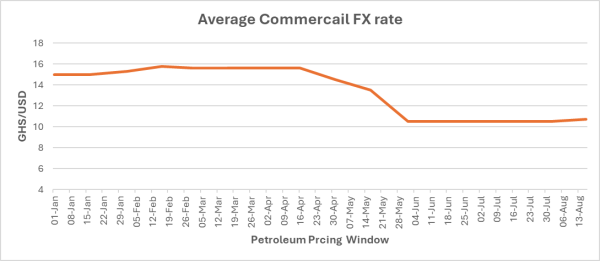

The Fufex30[1] for the second selling window of August (16th to 31st August) is estimated at GHS11.0000/USD, while the applicable spot rate for cash sales is GHS10.7500/USD based on quotations received from oil financing commercial banks.

The Ghana Cedi recorded significant performance in the first seven months of the year due to the prudent government fiscal policies and proactive monetary policies by the central bank. Available data shows that the cedi has appreciated by over 30% since January 2025.

This notwithstanding, BIDECs continue to raise concerns about the accessibility of USD from commercial banks to service their transactions with their suppliers. The inaccessibility of the USD invariably impacts the FX rate, leading to higher pump prices.

The Central Bank has announced its plans to reform the biweekly FX auction to BIDECs to a more unified auction. The new modalities will require BIDECs to participate in the Auction through their commercial banks on a daily basis, while submitting their import data and FX requirements to the NPA for approval to the BOG. This will ensure an increment in the volume of FX auction to BIDECS.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 16th to 31st August 2025

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 728.84000 | 691.1100 | 468.8000 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 200 | 200 | 255 |

| Spot FX Rates | 10.7500 | 10.7500 | 10.7500 |

| FuFex30 (GHS/USD) | 11.0000 | 11.0000 | 11.0000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 7.5387/ltr | 8.0946/ltr | 7.7809/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 7.7140/ltr | 8.2829/ltr | 7.9618/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th August 2025 selling window increased from 28.36%, 24.92%, and 15.23% of the ex-pump prices of petrol, diesel, and LPG, respectively, to 34.81% and 31.00% for petrol and diesel, respectively, due to the implementation of the GHS1/Ltr levy.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY SECTOR SHORTFALL AND DEBT REPAYMENT LEVY | 1.95 | 1.93 | 0.73 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 4.27 | 4.25 | 2.11 |

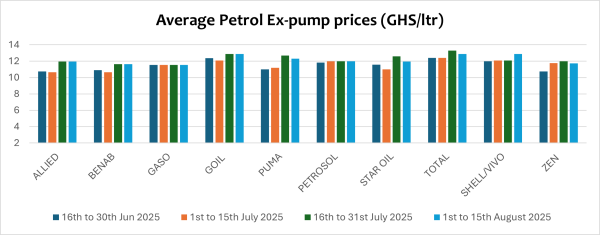

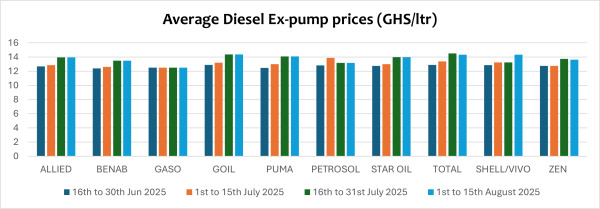

OMC Pricing Performance: 1st to 15th August 2025

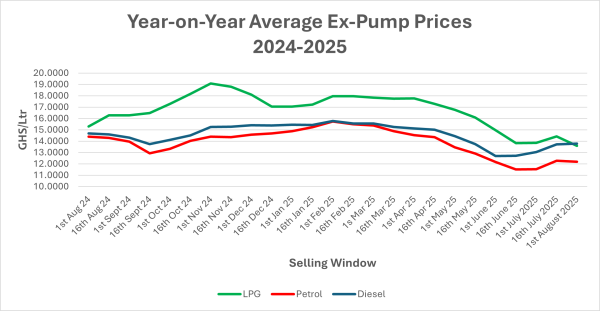

Pump prices of petroleum products have been on a downward trajectory since February following the significant appreciation and stability of the cedi against the US dollar and plummeting international price of crude and petroleum products. The cedi, which was trading at about GHS14.85/USD at the end of December 2024, has appreciated significantly since April and is currently trading at about GHS10.75/USD by the commercial banks as of 12th August 2025. This represents an appreciation of about 27% against the US dollar. The finance minister and government have attributed this appreciation to prudent management of the economy. The government has assured stakeholders that the appreciation of the cedi is not a fleeting development but the result of deliberate and strategic economic management.

The flexibility of the petroleum products Price Build-Up (PBU) in Ghana ensures that changes in the FX rate and related components are easily adjusted to reflect in the pump prices. This accounts for the bi-weekly adjustment of pump prices whenever the FX rate or international prices changes.

Despite the stability of the cedi/USD FX rate in recent times, importers, including BIDECs continue to raise concerns about the availability of USD in the market, forcing them to resort to alternative sources at higher rates. Stakeholders continue to call on government to streamline and sanitize the forex market to ensure availability of forex at competitive rates for petroleum imports.

Although pump price of petrol declined to an average of about GHS10.75/Ltr in the second selling window of June due to the combine effects of the appreciation of the Cedi and decline in international prices, the implementation of the Energy Sector Shortfall and Debt Repayment Levy (GHS1.00 Levy) in July caused a slight surge in pump price, currently selling at an average of GHS12.18/Ltr.

Average pump prices of diesel surged from an average of GHS12.69/Ltr in June to an average of GHS13.79/Ltr largely due to the implementation of the Levy. Pump prices of LPG, however, declined by about 20% since January due to the combined effects of the significant appreciation of the cedi and fall in global prices of petroleum products. Moreover, the government excluded LPG pump prices from the Energy Sector Shortfall and Debt Repayment Levy (GHS1.00 Levy) to promote LPG adoption as a clean transition fuel.

Pump prices are expected to edge slightly in the coming window (16th to 31st August) due to the marginal surge in prices of products in the international market and the slight depreciation of the cedi.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.