Crude Oil and Refined Products Market Review and Outlook

- Crude oil prices on the global market declined to their lowest since the beginning of the year. The fall in prices reflects weak macroeconomic fundamentals, lackluster demand and increasing crude oil production. According to the Energy Information Administration (EIA), the recent slowdown in China has seen its oil consumption declining year-on-year for a fourth consecutive month in July, by 280 kb/d.

- Crude oil prices have therefore fallen by about 21.02% on a year-on-year basis and 4.41% since the beginning of the year. Moreover, gasoline demand in the United States has witnessed a consistent decline in the first six months of 2024. Notwithstanding the decline, global oil demand on average is expected to increase by 900 kb/d in 2024.

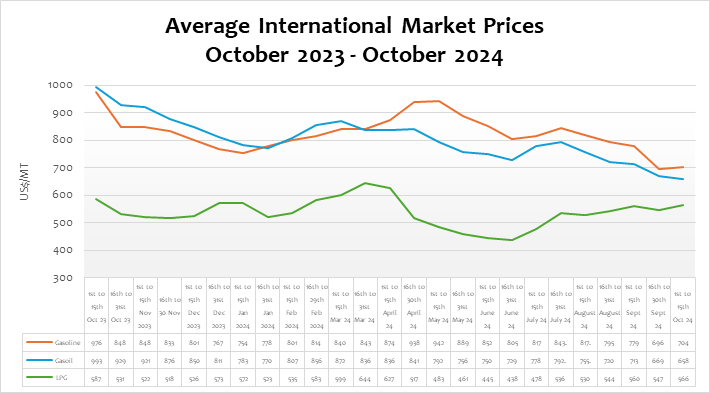

- On the global market, petrol and LPG prices rose by 1.09% and 3.63% respectively while the price of diesel declined by 1.67%. Crude oil prices fell from about USD76.53/bbl to USD74.87/bbl. This represents a year-on-year decline of 27.85%, 33.71%, and 3.59% for petrol, diesel, and LPG, respectively. On a year-to-date basis, petrol, diesel, and LPG declined by 6.59%, 15.91%, and 1.05%, respectively.

- The depreciating cedi and the slight increase in the global market price of LPG and petrol are expected to lead to a rise in pump prices in the first pricing window of October (1st to 15th October 2024).

FuFeX30 and Spot Rates

The Fufex30[1] for the first selling window of October (1st to 15th October 2024) is estimated at GHS16.1000/USD, while the applicable spot rate for cash sales is GHS15.9000/USD based on quotations received from oil financing commercial banks.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 1st to 15th April 2024 | 30% | 13.1160 |

| 16th to 30th April 2024 | 31% | 13.2259 |

| 1st to 15th May 2024 | 29% | 13.8643 |

| 16th to 31st May 2024 | 30% | 14.1419 |

| 1st to 15th June 2024 | 23% | 14.8388 |

| 16th to 30th June 2024 | 29% | 15.0523 |

| 1st to 15th July 2024 | 21% | 15.3169 |

| 16th to 31st July 2024 | 28% | 15.4526 |

| 1st to 15th August 2024 | 29% | 15.5647 |

| 16th to 31st August 2024 | 27% | 15.7311 |

| 1st to 15th September 2024 | 29% | 15.6062 |

| 16th to 30th September 2024 | 31% | 15.6631 |

| 1st to 15th October 2024 | 32% | 15.7994 |

The BoG’s bi-weekly FX auction to BIDECs in the 1st to 15th October 2024 pricing window for the purchase of petroleum products was US$20 million, representing 32% of BIDECs’ bid. The FX rate at which the BoG auctioned to BIDECs rose from GHS10.5151 in January to GHS15.7994 per USD in September, representing a depreciation of 50.25% year-to-date. The sharp depreciation of the cedi is robbing consumers of the benefits of the global decline in crude and petroleum product prices.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window, and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 1st to 15th October 2024

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 704.0000 | 658.2300 | 566.3600 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 95 | 100 | 240 |

| Spot FX Rates | 15.9000 | 15.9000 | 15.9000 |

| FuFex30 (GHS/USD) | 16.1000 | 16.1000 | 16.10000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 9.5916/ltr | 10.1872/ltr | 12.8211kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 9.7123/ltr | 10.3154/ltr | 12.9824/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 16th to 30th September 2024 selling window accounted for 25.31%, 23.72%, and 12.80% of the ex-pump prices of petrol, diesel, and LPG, respectively.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 3.27 | 3.25 | 2.11 |

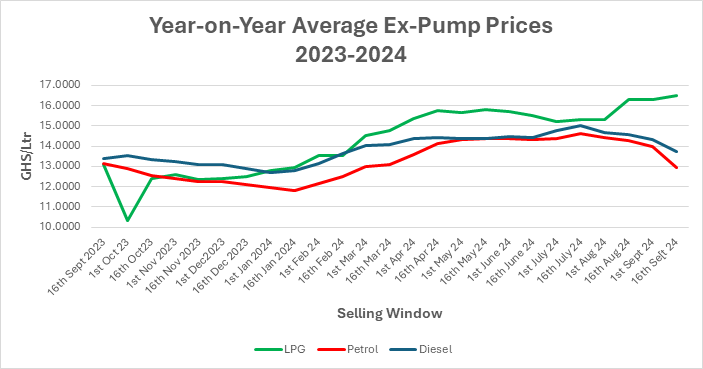

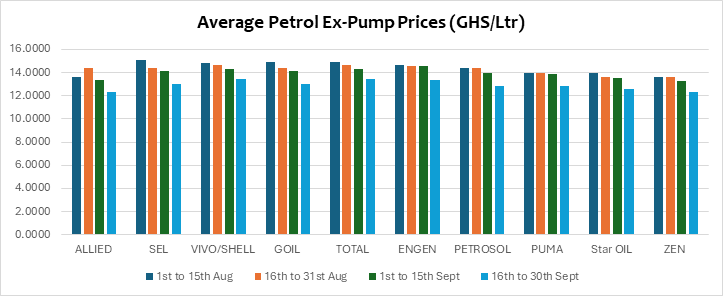

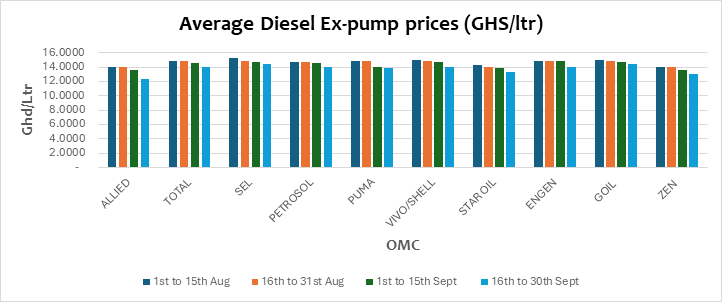

OMC Pricing Performance: 16th to 30th September 2024

- Petrol and Diesel prices have declined slightly for the fourth consecutive window, mainly as a result of the decline in global prices. The pump prices for both petrol and diesel have fallen below GHS14/Ltr for the first time since April 2024. Although the international market price of petrol and diesel declined significantly by about 27.85% and 33.71% respectively on a year-on-year basis, local pump prices of petrol have fallen slightly by 1.70% while diesel rose by 2.62% on a year-on-year basis.

- The pump price of LPG has risen by about 57.5% since October 2023. Pump price of LPG rose to its highest since November 2022 to about GHS16/kg. The rise in the price of LPG has been due to the increase in global demand and the depreciation of the Cedi. In the window under consideration, some LPGMCs sold LPG per kilogramme at GHS16.60. The continual increase in the LPG prices at the pumps will most likely defeat the government policy to increase national LPG penetration to about 50% by 2030.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

- The Ghanaian cedi has depreciated by an average of over GHS2.0000 against the USD since January 2024. This has greatly impacted the price of petroleum products at the pumps. The BOG auction rate to BIDECs has depreciated by over 40% since January 2024.

- Pump prices of petrol have increased by over 40% since March 2022 and by over GHS2/Ltr on average since January 2024. Petrol pump prices, which averaged GHS9.3390/Ltr in 2022, are currently being quoted at about GHS13.3500/Ltr by some OMCs. This surge is largely attributed to the sharp depreciation of the Cedi.

- Pump prices for diesel have also risen significantly since February 2023. Presently, diesel is being sold at an average rate of GHS14.3060/Ltr, compared to GHS12.7450/Ltr and GHS10.2740/Ltr in 2023 and 2022,

- Going into the last quarter of the year, global demand is expected to rise, which will potentially increase pump prices. However, a slight stability in the cedi within the period will reduce the impact of increasing global demand on Ghanaian consumers. Pump prices are expected to rise slightly in the 1st to 15th October pricing window due the depreciation of the cedi against the USD.