Refined Products Review and Outlook

Global crude oil prices continue to witness significant declines after the end of Q3. Crude oil prices rose significantly in Q3 to peak at USD94.76/bbl in September. This surge was attributed to a decline in global inflation and signs of economic recovery from China and the US, which resulted in a surge in economic activity. Another reason for the surge in prices was a reduction in production by major OPEC+ nations such as Saudi Arabia and Russia by about 1.6 million barrels per day. However, weak economic data from China and the US, has resulted in a significant fall in crude oil prices in Q4. Crude prices have fallen from about USD94.76/bbl in September to about USD81.84/bbl in November. According to CITAC Africa, crude oil prices have followed a sharp downward trajectory since mid-October as the global economic outlook worsened and the risk of a wider conflict in the Middle East appeared contained.

According to the IEA Oil Market Report for November, world oil output increased by 320,000b/d in October to 102mb/d. The Report states that crude production in the United States and Brazil is outperforming forecasts, helping to propel global supply higher by 1.7 million b/d to a record 101.8 million b/d in 2023.

Although China was projected to account for 1.8 mb/d of the total 2.4 mb/d increase that would lift global demand to 102 million b/d in 2023, recent data indicates that the world’s second-largest economy recorded about a 6.4% drop in export earnings in October 2023.

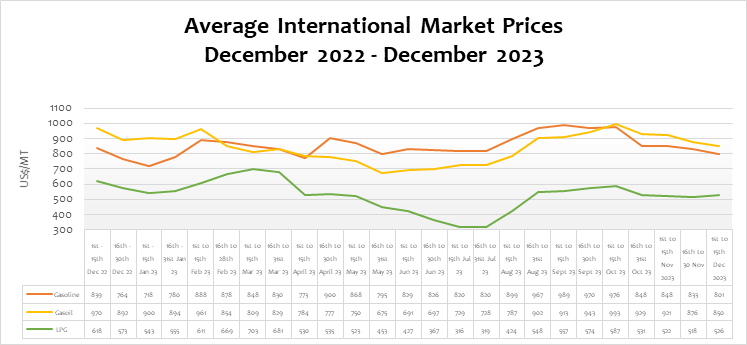

The international market price of petrol and diesel declined by 3.8% and 3.0%, respectively, while LPG rose by 1.6%. Compared to the same period last year, petrol, diesel, and LPG prices declined by 4.5%, 12.4%, and 14.9%, respectively. On a year-to-date basis, while the international market price of petrol rose by 11.6%, diesel and LPG declined by 5.6% and 3.1%, respectively.

FuFeX30 And Spot Rates

The Fufex30[1] for the first selling window of December (1st to 15th December 2023) is estimated at GHS12.3000/USD, while the applicable spot rate for cash sales is GHS12.1500/USD based on quotations received from oil financing commercial banks.

[1] The Fufex30 is a 30-day Ghs/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 16th – 30th April 2023 | 24% | 11.4467 |

| 1st – 15th May 2023 | 20% | 11.7575 |

| 16th – 31st May 2023 | 26% | 11.6943 |

| 1st – 15th June 2023 | 39% | 11.1657 |

| 16th – 30th June 2023 | 33% | 11.1781 |

| 1st – 15th July 2023 | 25% | 11.3737 |

| 16th – 31st July 2023 | 30% | 11.3737 |

| 1st – 15th August 2023 | 27% | 11.3312 |

| 16th – 31st August 2023 | 30% | 11.3460 |

| 16th – 30th September 2023 | 22% | 11.4232 |

| 16th – 31st October 2023 | 20% | 11.6435 |

| 1st – 15th November 2023 | 21% | 11.6824 |

| 16th – 30th November 20233 | 19% | 11.9131 |

The BoG’s bi-weekly FX auction to BIDECs in the 16th to 30th November 2023 pricing window for the purchase of petroleum products was US$20 million, representing 19% of BIDECs’ bid. The FX rate auctioned by BoG to BIDECs was GHS11.9131/USD, a depreciation of 1.9% compared to the previous auction rate.

[1] The Fufex30 is a 30-day Ghs/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

Ex-ref Price Effective 1st to 15th December 2023

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring the CBOD economic breakeven benchmark premium for a given window and converted from USD/mt to GHS/ltr using the FuFex30 for sales on credit and spot FX rate for sales on cash. The Ex-refinery price of Petrol is expected to range from GHS8.4505 to GHS8.5546 per liter while Diesel is expected to range from GHS9.9557 to GHS10.0786 per liter in the 1st to 15th December 2023 pricing window. The Ex-refinery price of LPG is expected to range from GHS8.5807 to GHS8.6866 per kilogram in the 1st to 15th December 2023 pricing window.

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 16th to 30th November selling window accounted for 24%, 22%, and 15% of the ex-pump prices of petrol, diesel, and LPG, respectively.

| TRM Components | Gasoline (GHS/ltr) | Gasoil (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.13 | 0.13 | – |

| BOST MARGIN | 0.09 | 0.09 | – |

| FUEL MARKING MARGIN | 0.5 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.75 | 0.75 | 0.75 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 2.96 | 2.94 | 2.01 |

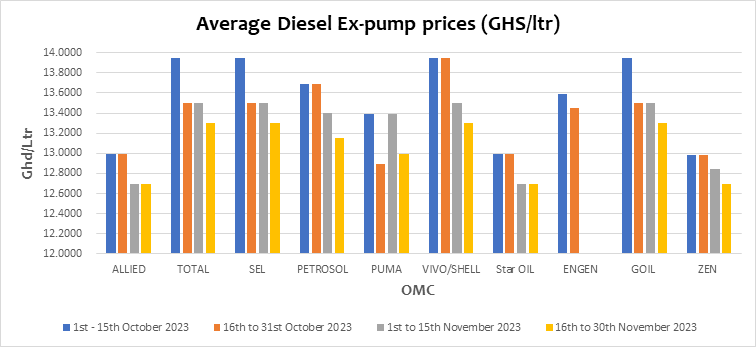

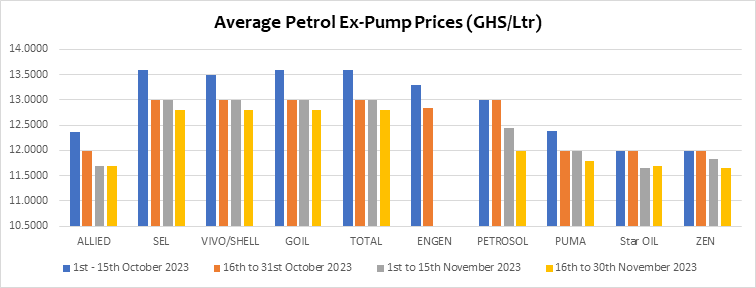

OMC Pricing Performance: 16th to 30th November 2023

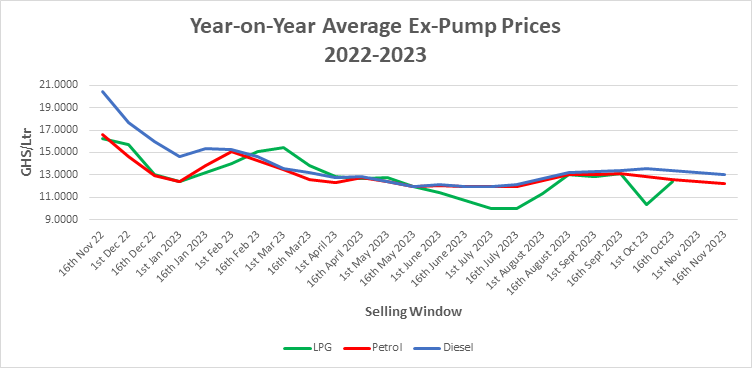

Prices of petroleum products at the pumps further declined marginally in the 16th to 30th November 2023, pricing window. The decline in prices was mainly attributed to a fall in global prices in the 27th October to 11th November 2023 international pricing window. The demand for crude and petroleum products slumped during the period due to a decline in global demand.

Crude prices rose significantly from about USD82.32/bbl in the first quarter of 2023 to about USD94.76/bbl at the end of September 2023. However, the price declined to about USD81.84/bbl in November. This notwithstanding, the IEA has projected demand to surge due to the significant cut in crude production by OPEC+, the fall in crude inventories, the mild post-COVID economic recovery in China, and increasing demand for jet fuels. According to Reuters, China’s economic activity perked up in October as industrial output increased faster and retail sales growth beat expectations, an encouraging sign for the world’s second-largest economy. These factors are expected to result in global demand outpacing supply by about 1.24 million b/d before the end of the year 2023.

Despite the Cedi’s relative depreciation by 5 percent against the USD in the reviewed selling window, there was a 2 percent decline in pump prices. Therefore, fuel prices are expected to remain stable going into the end of the year due to the expected depreciation of the Cedi in Q4, influenced by the usual increase in corporate demand for foreign exchange getting to the end of the year and the ongoing decline in global crude prices.

Pump prices of petrol declined by about 1.4% from an average of GHS12.3978/Ltr to GHS12.2244/Ltr in the second selling window of November. This was mainly due to the decline in global prices. On a y-o-y basis, petrol pump prices declined by about 4.5%, while on a y-t-d basis, they rose by 11.6%. This declining trend is expected to be reversed going into December as Saudi Arabia and Russia resolve to maintain their decision to cut production through to the end of the year. This will result in an increase in global prices of petroleum products.

| Average Petrol Ex-pump prices (GHS/ltr) | |||

| OMC | 1st to 15th November 2023 | 16th to 30th November 2023 | % Change |

| ALLIED | 11.6900 | 11.6900 | 0.0% |

| SEL | 12.9900 | 12.8000 | -1.5% |

| VIVO/SHELL | 12.9900 | 12.8000 | -1.5% |

| GOIL | 12.9900 | 12.8000 | -1.5% |

| TOTAL | 12.9900 | 12.8000 | -1.5% |

| PETROSOL | 12.4500 | 11.9900 | -3.7% |

| PUMA | 11.9900 | 11.7900 | -1.7% |

| Star OIL | 11.6500 | 11.6900 | 0.3% |

| ZEN | 11.8400 | 11.6600 | -1.5% |

| AVERAGE | 12.3978 | 12.2244 | -1.4% |

Diesel prices declined marginally by about 1.3% from an average of GHS13.2233/ltr to GHS13.0456/ltr in the 16th to 30th November 2023 selling window. On a year-on-year basis, pump prices for diesel declined by about 12.4% and 5.6% year-to-date. From the second selling window of June to the current pricing window, diesel pump prices have risen by about 11%. This rise is attributed to international market factors, as the Cedi/USD exchange rate remained steady throughout Q3.

| Average Diesel Ex-pump prices (GHS/ltr) | |||

| OMC | 1st to 15th November 2023 | 16th to 30th November 2023 | % Change |

| ALLIED | 12.6900 | 12.6900 | 0.0% |

| TOTAL | 13.5000 | 13.3000 | -1.5% |

| SEL | 13.5000 | 13.3000 | -1.5% |

| PETROSOL | 13.4000 | 13.1500 | -1.9% |

| PUMA | 13.3900 | 12.9900 | -3.0% |

| VIVO/SHELL | 13.5000 | 13.3000 | -1.5% |

| Star OIL | 12.6900 | 12.6900 | 0.0% |

| GOIL | 13.5000 | 13.3000 | -1.5% |

| ZEN | 12.8400 | 12.6900 | -1.2% |

| AVERAGE | 13.2233 | 13.0456 | -1.3% |

With the decline in global prices of refined petroleum products and the appreciation of the cedi, pump prices of petrol and diesel are expected to slightly decline by about 4% and 3% respectively, while LPG is expected to rise by 1% in the first selling window of December 2023.